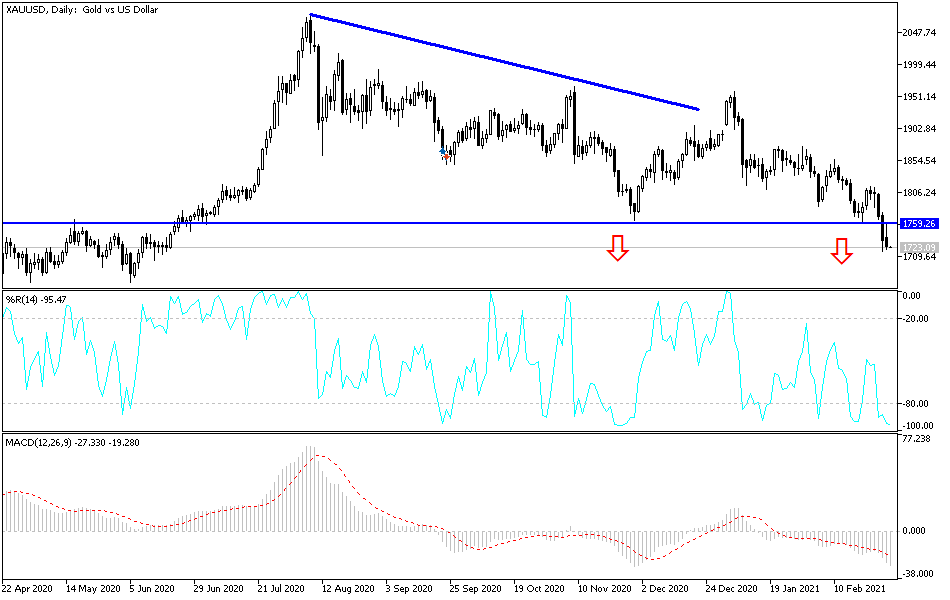

Gold markets initially tried to rally during the trading session on Monday to kick off the week but continues to see resistance above the $1450 level. We ended up forming a bit of a significant inverted hammer, which is a major bullish signal if we can break above the top of it. However, if we break down below, it is very likely that we are going to see a drift lower. If we can break down below the $1700 level, then it is likely that the market will drop down to the $1500 level.

Interest rates rising in the United States continues to be a major problem for gold markets and therefore you need to pay attention to the 10-year yields and the like. If yields continue to rise, it makes more sense for traders to clip coupons on a bond then it does to pay for storage. Higher real yields are like kryptonite for the gold market, and that is exactly what we are seeing right now. I think it is only a matter of time before the market is going to have to react to this, as money managers move large portions of their portfolios around.

If we do break down below the $1700 level, I think that the move to the downside could be a bit quicker, thereby adding a flood of orders into the marketplace, and the $1700 level has been an area where we have seen a lot of pressure to the upside as it was the breakout point. It certainly looks as if the gold market is in serious trouble, and it is also worth noting that as I write this, the 10-year note is 1.44%, which is not even the highest level that we have seen at that. In other words, if we reach back towards the high yields, the gold markets will more than likely get crushed.

On the other hand, if we were to break above the top of the candlestick, we might make a move towards the $1800 level. If we can break above the $1800 level, then we could go higher. However, it certainly looks as if we have serious issues and, for what it is worth, the so-called “death cross” is about to happen, so some people put a certain amount of credence into that indicator.