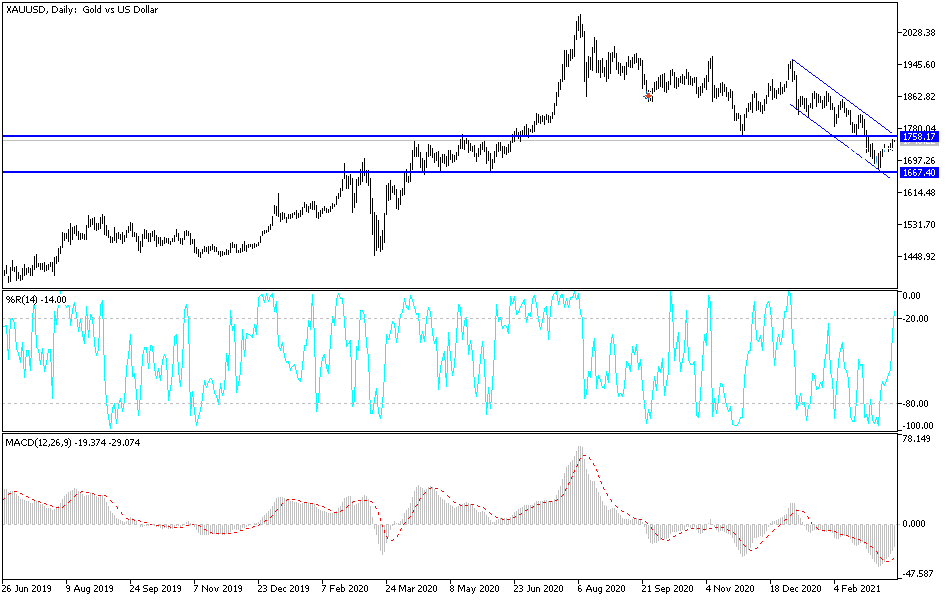

Gold markets rallied a bit during the trading session on Wednesday as we saw the FOMC come and go. It does not look like the Federal Reserve is ignoring interest rates, although they did not come out and say anything explicit that they were prepared to do. With that in mind, it looks as if we are going to continue to see gold trying to recover from the recent bounce at the $1700 level.

Part of what we have seen during the trading session on Wednesday was that people were buying bonds again, driving down yields ever so slightly. Chairman Powell also suggested that perhaps the Federal Reserve would step up buying if it had to, to keep the interest rates under control. He also suggested that they planned on raising rates in the next few years, but at this point they also plan on letting inflation run hotter than usual, which prompts people to start buying gold. At the same time, it looks like he has stopped short of doing yield curve control, but clearly there are some concerns out there when it comes to the idea of interest rates shooting straight up in the air. As long as that is going to be the case, people have to believe that sooner or later the Federal Reserve is going to step in.

That should bode well for gold longer term, but in the short term we are going to have to continue to play the “inverse correlation game” between the 10-year yield and gold markets in general. After all, if you get more yield clipping coupons, then it is a much safer bet than trying to pay for the storage of gold. It is a simple matter of getting a better return. A “risk free rate of return” is what people really like at the end of the day, and storing gold can be quite expensive over the longer term. I do think that we are probably going to try to continue to go higher, but for the short term, I do not know whether or not we can break above $1800. I think that answer will be found in the bond market.