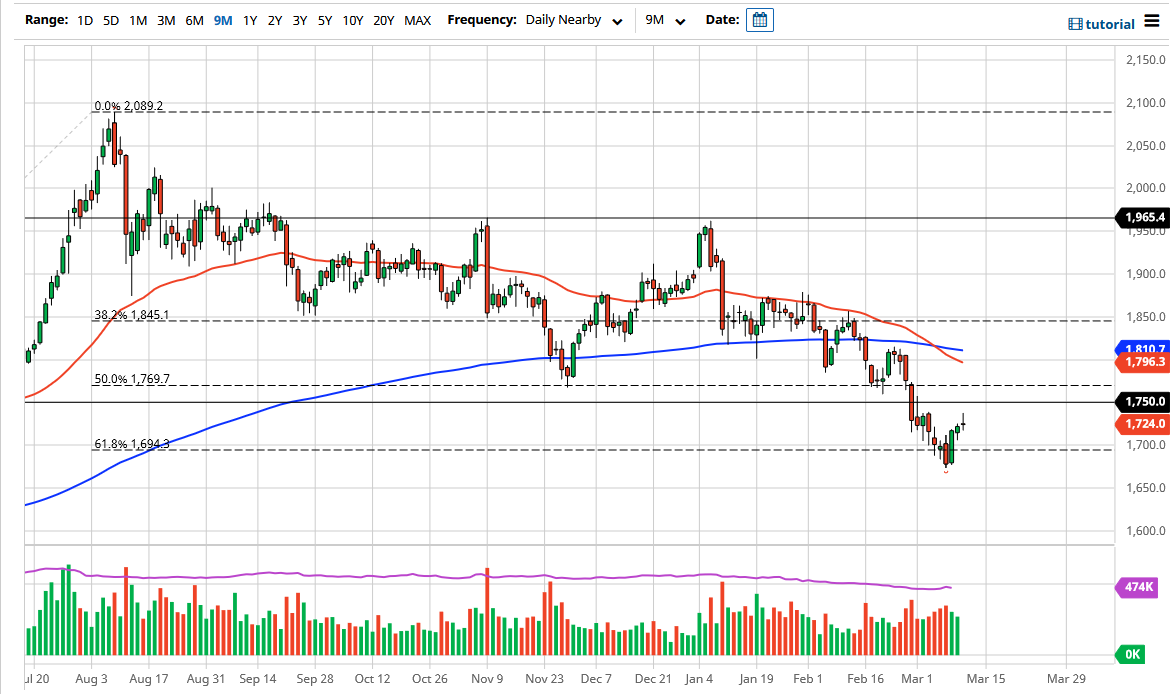

The gold markets initially looked very bullish during the trading session on Thursday but gave back a significant amount of the gains to turn around and form a massive shooting star. This is exactly what those looking for gold to turn things around do not want to see. The $1750 level looks to be rather important, so if we were to finally break above there and perhaps more importantly close above there, then I think you could get more buyers jumping into the market. However, we have clearly struggled to get up there during the trading session, so I think that it is only a matter of time before we see sellers jump back in and push this market lower.

To the downside, I believe that the lows from both Monday and Tuesday are crucial. If we do break down below the bottom of that low, then it is likely that we could see gold really start to accelerate to the downside. At that point, the market is likely to go looking towards the $1550 level, possibly even the $1500 level. The $1500 level course is a large, round, psychologically significant figure and of course will be paid close attention to buy the news media and of course large traders around the world. This of course would also have a lot to do with the US dollar, which has been thrown around due to the idea of yields jumping back and forth. That being said, gold suddenly looks very soft although I do like it from a longer-term standpoint. We simply have not found the bottom quite yet, or at least it does not look like we have.

The question is whether or not there will be any true inflation? As yields rise in the bond market, it offers the idea of positive “real rates”, meaning that you can actually be inflation by clipping coupons in the bond market. If that is going to be the case, then there is no point whatsoever in speculating. This is exactly what kills gold because you have to pay for the privilege of storing it. Looking at this chart, I think that we probably have further work to do underneath in order to stabilize the gold market. With this, I think short-term the market has further to go lower, but eventually it will become a brilliant “buy-and-hold” situation.