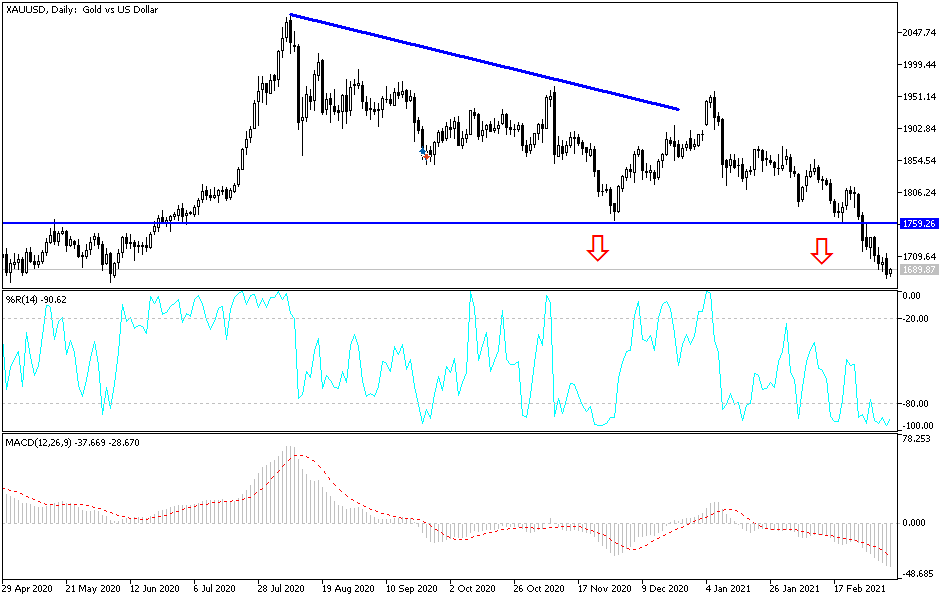

Gold markets initially tried to rally during the trading session on Monday but gave back the gains rather quickly. By doing so, we have drifted below the $1700 level yet again, an area that a lot of people will be paying close attention to. The fact that we are closing towards the bottom of the candlestick also suggests that we could go lower, so I think gold will continue to be threatened in general. The market is one that now looks likely to go looking towards the $1500 level, but that does not necessarily mean we will get there overnight. Every time we rally, you will be looking for selling opportunities to get involved.

Gold markets are currently reacting to the strength in the bond market, because the strengthening yields continue to make the US dollar attractive. That weighs upon the gold market, because it takes less of those dollars to buy an ounce of gold. Furthermore, there are a lot of concerns when it comes to the cost of storing gold instead of simply clipping coupons in the bond market.

At this point, the market looks as if it is ready to continue to go lower, perhaps after a short-term bounce, but I am looking for short-term candlesticks that have long wicks to the upside that I can start to sell into. This is a market that eventually will get that opportunity, so simply being patient enough to take it is my plan going forward. I would probably look to the hourly chart, just because I believe that the $1700 level should be resistance. On the other hand, if we were to break down below the candlestick for the trading session on Monday, that also is a sell signal as well.

In fact, it is not until we break above the $1750 level that I would remotely consider buying gold. If we do break above there, then I think it could be the beginning of a rather nasty reversal. For what it is worth, the 50-day EMA has recently broken below the 200-day EMA, forming the so-called “death cross” that some people pay close attention to. It does cause headlines, but really at this point it is typically a signal that is too late to take advantage of.