Gold markets have been at the mercy of the bond market for some time now, and it now looks like more of the hijinks over there is starting to affect the market over here. It appears that Wall Street traders are trying to form some type of tantrum to make the Federal Reserve get involved again to save the equity markets.

This unfortunately has an influence on every other market, because it affects the “risk-free rate of return” when it comes to bonds. In other words, as we get higher yields, it makes sense that a lot of traders would simply prefer to clip coupons in a bond market instead of taking the risk of buying equities or in this case, precious metals. It costs money to store gold, and that is one of the biggest problems with owning it. It has no rate of return other than potential purchases of the gold contract itself, so it is something that you need to be very cognizant of.

Most of you are not bond traders, but you should probably get accustomed to tracking yields in the United States for the time being. The 10-year note rose above the 1.75% level, which had people running towards bonds to purchase them and selling anything that was not a bond. The fact that you have to pay to own gold is part of what works against it. Furthermore, you have crypto currency now taking the shine off of the metal as it is much cheaper to store imaginary digits then it is actual physical gold. As long as we find ourselves in this conundrum when it comes to the bond market, it is very difficult to imagine a scenario where we simply take off to the upside in gold without something drastic happening.

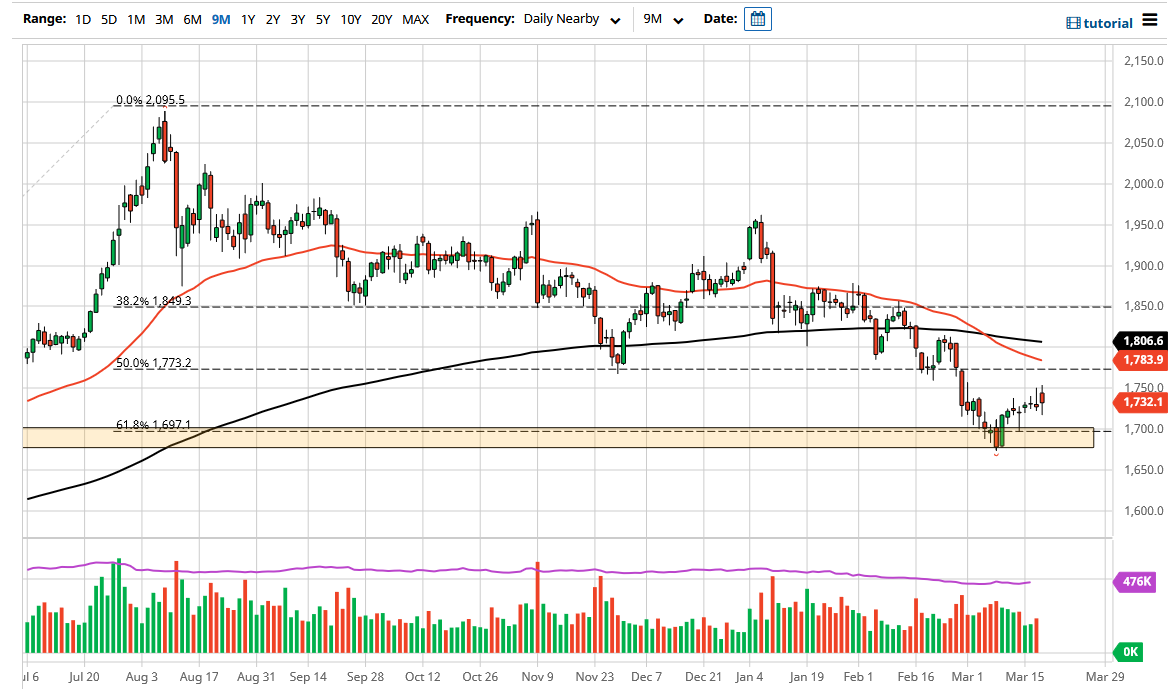

From a technical analysis standpoint, we have still bounced from a major support level in the form of the $1700 level, so that is something worth paying attention to. After all, the 61.8% Fibonacci retracement level sits right there at the $1700 level, and that is something to be aware of. However, if we were to break down below the lows of last week, then it is very likely that we would then go looking towards the $1500 level, as I see a big “air pocket” underneath that region.