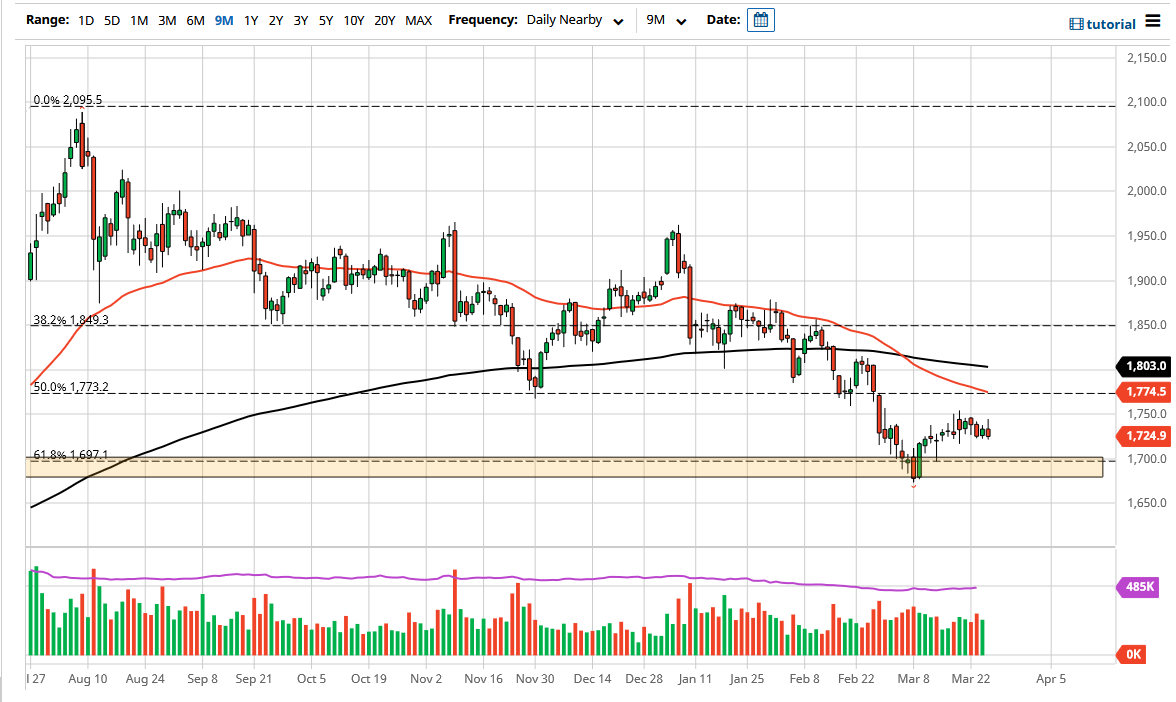

Gold markets initially tried to rally on Thursday but gave back the gains later in the day to form a less than ideal candlestick. At this point, the market is likely to see the $1700 level as a target, and of course the most recent low after that. The low being broken to the downside would have me selling gold again, as it could open up a massive move down towards the $1500 level where I would expect to see much more in the way of interest.

The US dollar has been strengthening for some time now, as interest rates continue to rise and of course people are concerned about the overall growth of the global economy. As long as the greenback continues to be seen as a place that people want to put their money into, that will weigh upon gold. Interest rates in America continue to strengthen, so therefore it offers a “real rate of return” in that it is outpacing inflation, or at least coming closer. On the other hand, the gold market is held hostage to the idea of paying for storage when it comes to owning gold, so that is what is currently working against a bullish move.

From a technical analysis standpoint, the $1700 level is an area where we had seen devious resistance, so it does make sense that we would see support. On the other hand, you should also take a look at that level as supportive due to the fact that the 61.8% Fibonacci retracement level is right there. However, it certainly looks as if there is still a lot of fundamental issues out there, and it does make sense that we continue to see a lot of pressure to the downside. However, if the yields in America drive up and perhaps more importantly, the US dollar drops, then we could see an attempt to break above the 50 day EMA at the $1775 level. At that point, the next target would be the $1803 level where we have the 200 day EMA. If you can break above there, then you can start to see a significant move to the upside, perhaps changing the trend. Until that happens though, I do not anticipate that this is a market that you can trust to the upside.