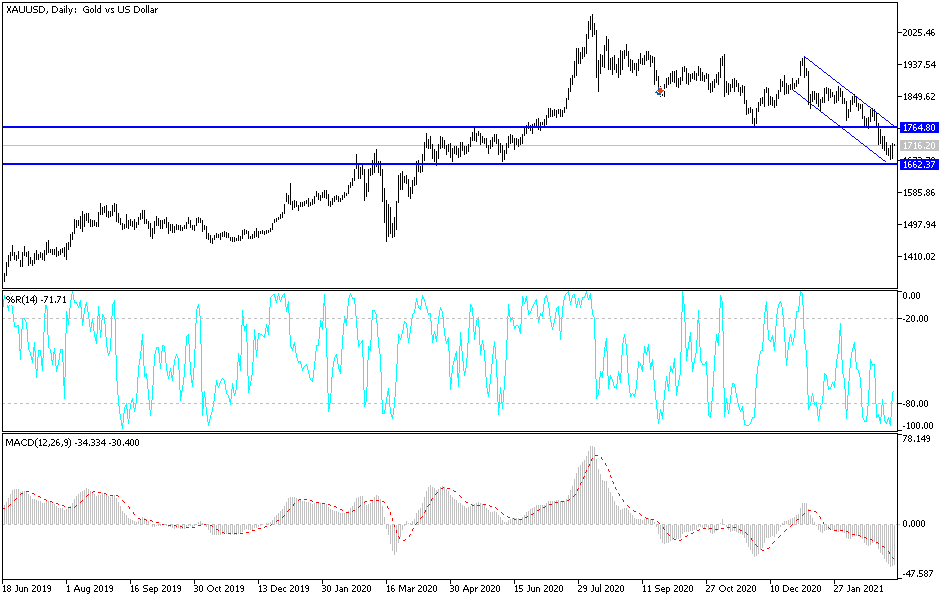

Gold markets rallied significantly during the trading session on Tuesday to bounce from a crucial support region. We are currently near the 61.8% Fibonacci retracement level and are hanging on for dear life to the $1700 region. By forming the massively bullish candlestick that we have, this does suggest that perhaps we may be looking at the end of selling, because this is exactly where you need to hang onto very forcefully as far as the shape of the candlestick is concerned. If we can break above the highs of the candlestick, then it is likely that we could go looking towards the $1750 level next.

On the other hand, if we were to pull back a bit from here, we will probably continue to go back and forth during the session within the width of the candlestick. A lot of this comes down the yields in the United States in the 10-year note, as it has rallied quite significantly. Those higher yields makes the US dollar much more attractive, and works against the value of gold as a result. Furthermore, it is also more attractive to clip coupons in the bond market than it does to pay for the storage of gold. However, if the yields in America continue to drop like they did during the trading session on Tuesday, we could see a resurgence in the gold market. With this being the case, I think you have to keep an eye on both charts and trade them adversely if you plan on trying to make any money.

If we do see a spike in the yields yet again, we could see the market break down below the lows of the past couple of sessions, which could open up a move down towards the $1550 level, possibly even down to the $1500 level. That would be a very strong move, but based upon the reaction that we have seen during the Tuesday session, the likelihood of that happening shrank quite a bit, despite the fact that this was just one session. I think the one thing you can probably count on in the next couple of trading sessions is that we will see a lot of choppiness more than anything else.