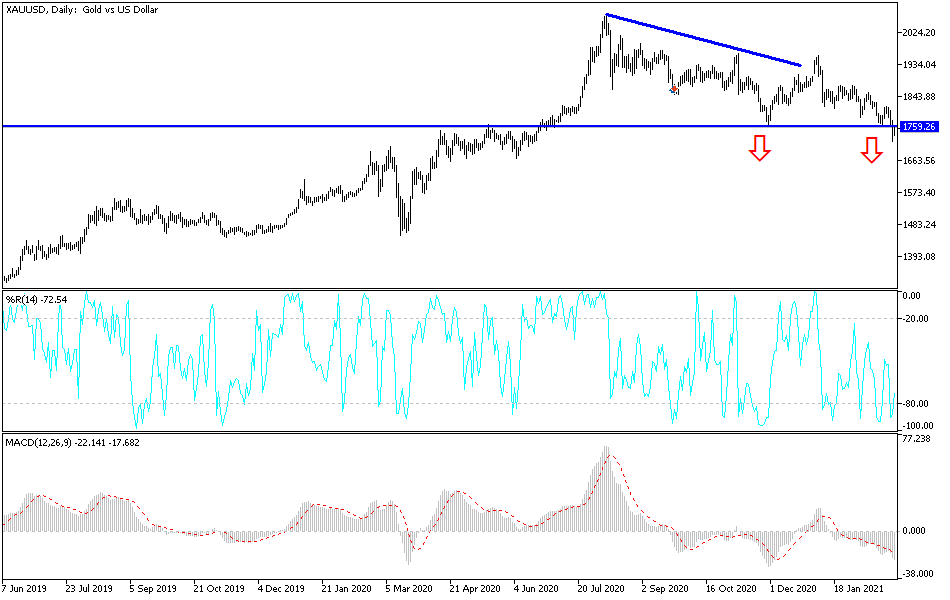

Gold markets have broken down significantly during the trading session on Friday, slicing through the $1750 level. This is the beginning of the “floor in the market” that I think could extend down to the $1700 level. At this point, if we were to break down below that level, it is very likely that gold markets would plunge quite drastically, perhaps in a move down to the $1500 level. After all, this is an area in which we have seen a lot of structural support, and if we do not hold this region, things could get quite ugly in the short term.

The size of the candlestick is something worth paying attention to, as it is relatively long, so I think what we are looking at is a real problem for the gold market. The biggest issue is the fact that the yields in the bond market continue to rally, and that is toxic for gold as it is cheaper and easier to simply clip coupons in the bond market than it is to pay for storage. Storing gold gets to be expensive given enough time, so it is likely that we will see more negative pressure if we can continue to see yields rise in America.

The yields rising the way they have has put bullish pressure on the US dollar, so it takes less of those dollars to buy gold. This is why you see a bit of a divergence between the market price in US dollars and other currencies sometimes. If we were to break down at this point, I would be a seller of gold underneath the $1700 level, only to turn around and buy it closer to the $1500 level, because I think eventually people will start to worry about inflation again. If that is going to be the case, the market is likely to be very noisy, and I do think that longer-term the gold market is a great “buy-and-hold” type of scenario, but we are not there yet. I think we have another flush lower at this rate, but if we were to turn around and recapture the $1800 level, then that could change things and have this market turned around quite rapidly. That does not seem likely to happen based upon the action that we have seen, so it would be very extraordinary and bullish.