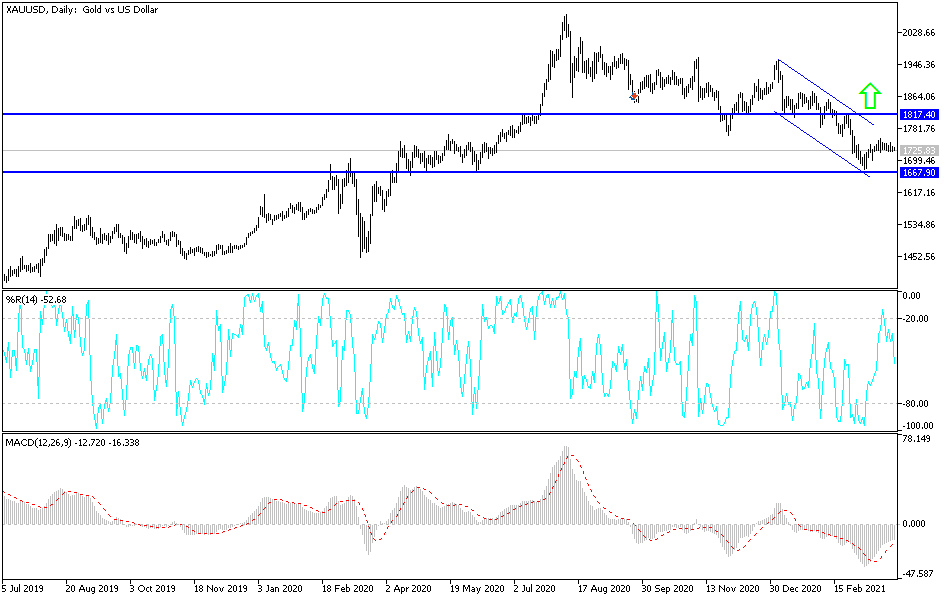

Gold markets have done nothing over the last couple of weeks, and unfortunately, I can say the same thing for the Friday session. We are hanging about the $1730 level, which is a bit of a magnet for price at this moment. Nonetheless, I think the real support underneath near the $1700 level will attract a lot of attention, as it is the 61.8% Fibonacci retracement area, and an area that we had bounced from previously.

If we were to break down below that recent low, that opens up quite a bit of selling pressure in the gold market, opening up the possibility of a drop all the way down to the $1500 level. This would probably be accompanied by rising yields in America or some type of major sell-off of risk appetite-related stuff in general.

To the upside, we have the 50-day EMA, which is sitting at the $1772 level and sloping lower to show signs of weakness. That being said, the market is likely to continue to see a lot of resistance, especially extending all the way to the 200-day EMA. If we were to break above the 200-day EMA, which is close to the $1800 level, then I would be a buyer of this market. Until that happens, I think gold is still something that you should be selling on short-term rallies that show signs of exhaustion. This will be especially true for short-term charts. Gold continues to look very soft, but you could make an argument for the fact that we have not fallen again as the beginning of some type of base-building exercise. It still too early to say that with any type of certainty, but it is worth noting that the silver market also looks as if it is trying to form a base.

I think the one thing you can probably count on is a lot of short-term noise overall, so it is imperative that you keep your position size somewhat small, at least until we get an impulsive candlestick that we can follow on the daily timeframe. I believe that the next couple of weeks are going to be about trying to decide whether or not the uptrend from the last couple of years can hold, or if we are destined to continue breaking down.