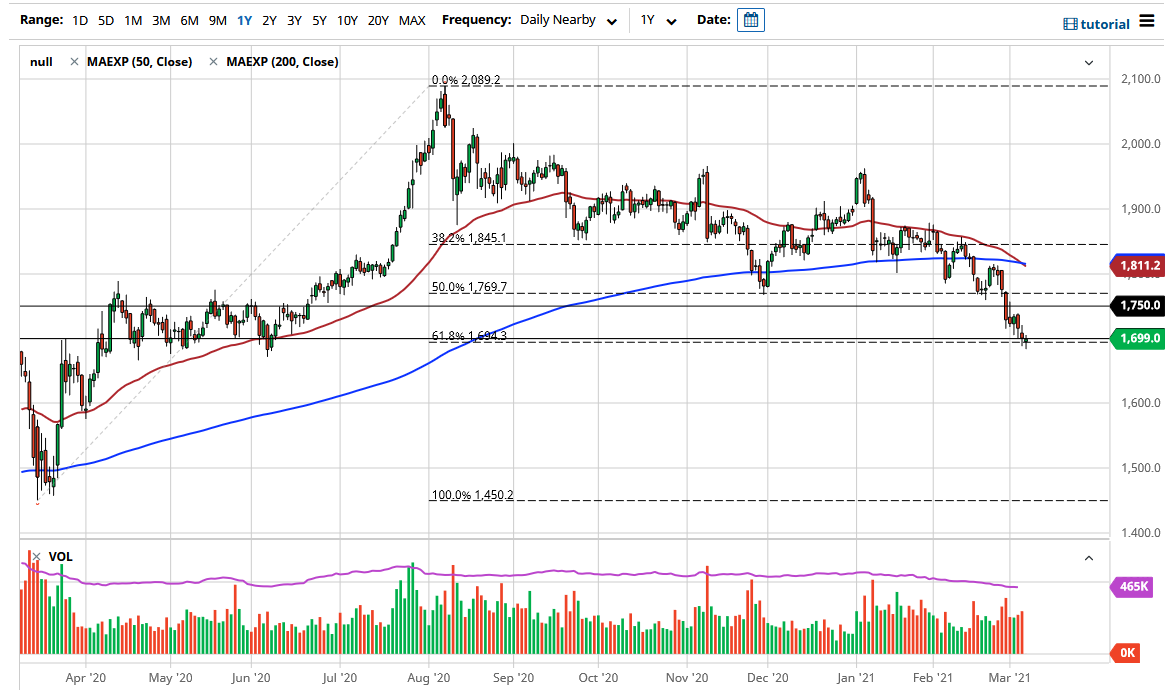

Gold markets have gone back and forth during the course of the trading session on Friday, as we are hanging around the $1700 level. This is a market that has formed a little bit of a hammer on Friday, after forming a bit of a neutral candlestick on Thursday. The 61.8% Fibonacci retracement level is important from a technical standpoint as well, so it all ties together quite nicely around that $1700 level.

If we turn around a break above the highs of the trading session, then it is likely that we could make a push towards the $1730 level. If we break above that, then the market could go looking towards the $1750 level. If and when we can break above there, then the market is likely to go much higher. This is an area where we need to hang onto if we are going to save this trend. I do recognize that the “death cross” just happened, but that quite often shows up a bit too late to make it very effective.

A lot of what we are seeing is in reaction to bond yields in the United States, and as a result as yields rise it makes sense that gold would fall and of course vice versa. The gold markets look at yields as toxic due to the fact that it is cheaper to simply keep bonds and clip coupons that it is to pay storage fees for gold. At this point in time, the market does look a bit exhausted to the downside, just like it is a bit exhausted from a yield situation. I do not necessarily think that we are quite ready to call a top or bottom in either one of these markets, but we are getting a bit stretched.

I think the one thing that you can probably count on is a lot of back and forth and choppy behavior, but I do think that given enough time the gold markets will go higher over the longer term, as the inflation situation will eventually start to cause major problems. Nonetheless, in the short term you are best off simply buying small bits and pieces so that you can hold onto a trade for a bigger move. Longer-term, I think that we probably revisit the $2100 level eventually.