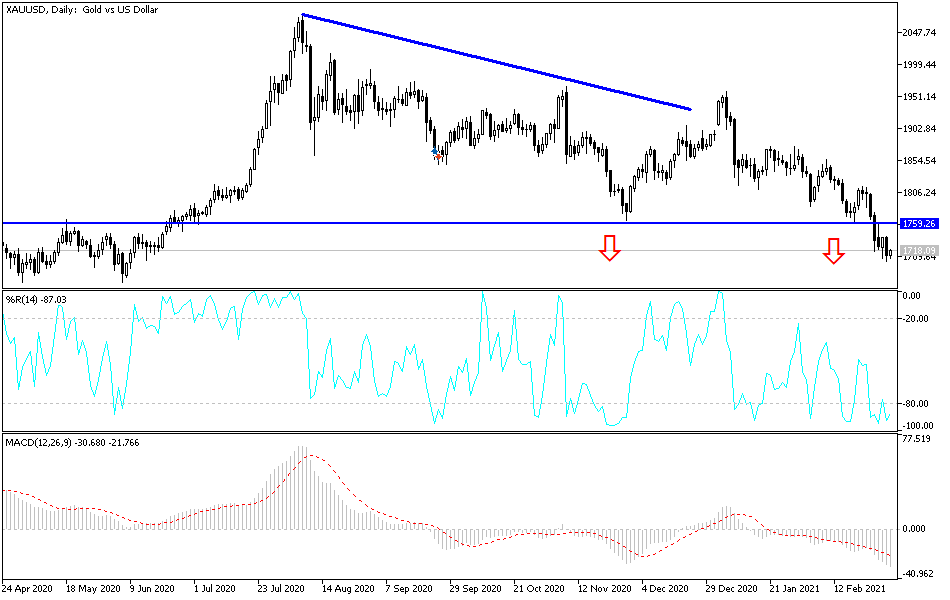

Gold markets have gotten hammered again during the trading session on Wednesday to reach down towards the $1700 level. The $1700 level is a major round figure that a lot of people will pay close attention to. In fact, if we were to break down below that level, it is likely that we could open up a move all the way down to at least the $1550 level, possibly even as low as the $1500 level. The $1500 level would be a large, round, psychologically significant figure that will attract a lot of headlines, so it will be interesting to see how the market behaves if we do go down there.

If we were to break down, the most likely scenario would be due to a spike in US yields, which we have seen drive down the price of gold for some time now. Furthermore, we also have the so-called “death cross” getting ready to happen, as the 50-day EMA is likely to break down below the 200-day EMA. I am not a huge proponent of using that as a trade signal, but I know enough people out there who do that.

The $1750 level above is resistance, so if we were to close above there on the daily chart, then I think the market will probably go looking to challenge the $1800 level. After that, we can go looking towards the $1850 level and so on. We are at a place on the chart right now that needs to hold if we want any hope whatsoever of an uptrend going on into the future, otherwise we need some type of massive breakdown in order to “reset” the entire market. I do believe that eventually gold will take off, but we may have to pull back even further before it happens.

I need to see a daily close below that $1700 level to actually short though, because it will help with the idea of the false breakdown. With that being the case, pay close attention to the 10-year yield, because if it continues to rise rapidly that will absolutely hammer this market to the downside. Furthermore, if the 10-year yield starts to drift lower, that should turn this market around and cause that to find some support.