Gold prices continued to collapse as Treasury bond yields and the US dollar continued to rise and pushed investors to abandon the yellow metal. The price of gold retreated to the $1677 support level, its lowest in ten months, before stabilizing around $1693 as of this writing. What added to the price of gold for the current decline is the rise of the US Dollar Index to its highest level in three months, while the 10-year yield has stabilized near the highest level in more than a year, which increases the opportunity cost of owning gold.

Commenting on the performance, Bart Millick, Head of Commodity Strategies at TD Securities, told Reuters: "We have the economy recovering and inflation is emerging. Ultimately, this means that the yields have room to rise." Millick added that the price of gold may fall further towards $1660 as a result.

Even the approval by US Congress of President Joe Biden's $1.9 trillion relief package, which would have raised inflation expectations, failed to sustain gold's gains. Gold is widely seen as a hedge against inflation, which is likely to stem from broad stimulus, but high bond yields this year have threatened this situation as they translate into a higher opportunity cost of owning bullion.

Analysts also believe that the failure of US Federal Reserve Chairman Jerome Powell to address the recent rise in yields last week added to the pressure on gold.

For her part, US Treasury Secretary Janet Yellen continues to advocate the approval of the US stimulus plan. Yellen expects that the bill will allow the country to return to full employment by next year, noting that the Congressional Budget Office has estimated that without the relief package, the country will not return to full employment until 2024.

Once the relief measure is approved, Yellen added, the administration will win approval for a "Build Back Better" bill that will boost infrastructure spending and provide support to improve educational and job training opportunities as well as include improved childcare. Yellin also said that the proposal would address problems "which have been aggravating for a long time." Asked about some economists’ concerns that this measure could stimulate the economy too quickly and lead to higher inflation, Yellen said: “I don't think this will really happen. We had an unemployment rate of 3.5% before the pandemic and there was no sign of further inflation.”

The US House of Representatives is expected to give final approval to the relief bill this week, and the administration said the president will sign the measure once he gets to his office. The expanded unemployment benefits for Americans are expected to expire on March 14th if new legislation is not passed.

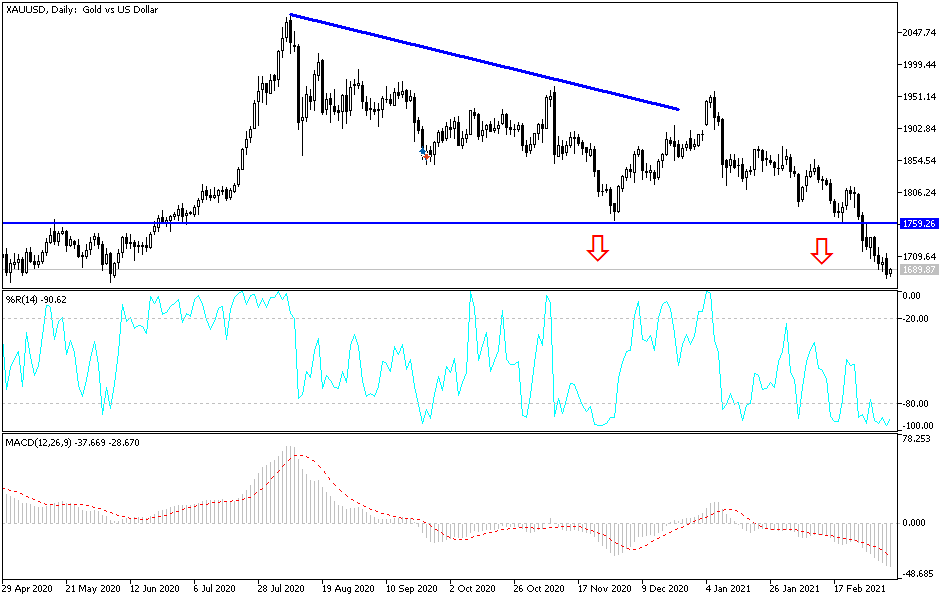

Technical analysis of gold:

On the daily chart, the price of gold is still moving within a sharp descending channel. That started in the beginning of 2021 trading amid sharp selling that started from the resistance level of $1959, at which time gold's losses reached the support level of $1677 dollars, a 10-month low. There will be no opportunity for the bulls to control performance again without breaching the resistance level of $1800, which will depend on the US dollar losing strength and a calm appetite in the bond market. The recent selling has pushed the technical indicators to strong oversold levels, and the most appropriate levels to buy gold are currently $1680, $1662 and $1640 dollars.

Today's economic calendar is devoid of important US economic data, but gold will interact with the announcement of the growth rate of the Japanese economy and the Eurozone.