The price of gold benefited a lot from the halting of the gains in the US dollar after disappointing US retail sales numbers were announced. The gold price moved to the $1741 resistance level before settling around $1735 in a narrow range trade ahead of the monetary policy decisions of the US Federal Reserve Bank later today. Despite the strong expectations that the bank will keep US interest rates unchanged, investors are focusing on the bank’s monetary policy statement and the statement of its chairman, Jerome Powell. These will hopefully reveal the bank’s vision about what happened in the bond market recently, inflation concerns and the official passage of the economic stimulus.

Yesterday, data showing a decrease in US retail sales and a decrease in industrial production contributed to the rise in the price of gold. The US dollar maintained slight gains and US Treasury yields rose as investors await the Federal Reserve meeting.

Silver futures closed lower at $26.003 an ounce, while copper futures settled at $4.0715.

Economic data released by the Commerce Department showed that US retail sales fell by much more than expected in February, dropping by -3%, after rising by an upwardly revised 7.6% in January. Economists had expected retail sales to decline 0.5% compared to the 5.3% rise originally reported for the previous month.

Analysts at JPMorgan Chase expected retail sales to decline in February after icy Texas weather caused blackouts and forced some stores to close temporarily. The bank also said that credit and debit card spending fell sharply after the storm in Texas, as well as neighboring states, such as Arkansas and Mississippi. Retail sales are expected to rise again in March as many Americans receive direct payments of $1,400, part of a $1.9 trillion relief package from COVID-19 that was signed into law last week.

The Federal Reserve released a report showing an unexpected drop in US industrial production in February, with a sharp drop in manufacturing and mining production more than offsetting the sharp increase in utility production. Accordingly, the Federal Reserve said that industrial production fell by -2.2% in February after it jumped by an upwardly revised 1.1% in January. Economists had expected industrial production to rise 0.6% compared to the 0.9% increase originally reported for the previous month.

The expansion in vaccine distribution is expected to boost economic growth in the second half of this year as people become less afraid of contracting the virus. There are already signs that this is happening. Employers added 379,000 strong jobs in February, helped by the sharp increase in employment in restaurants and bars.

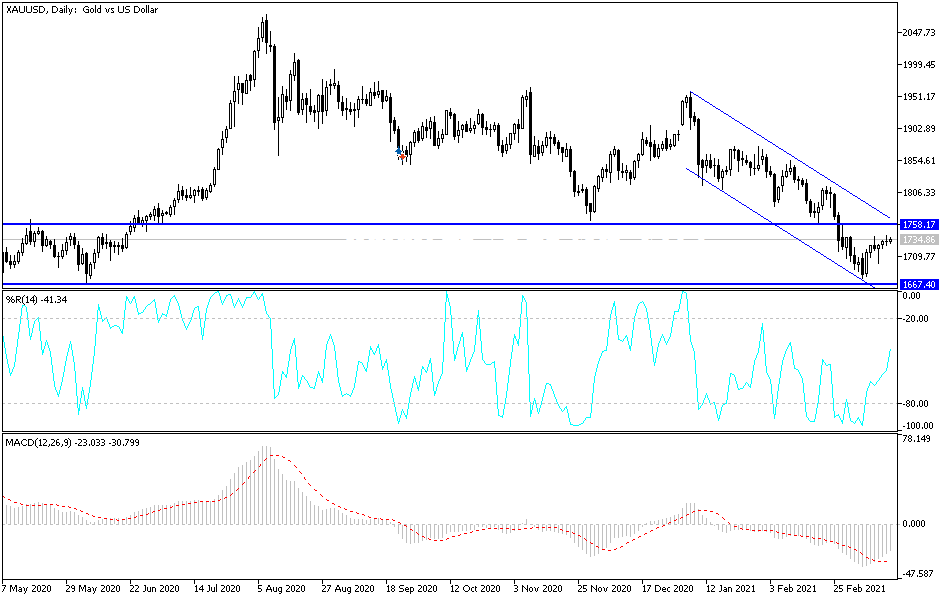

Technical analysis of gold:

According to the performance on the daily chart, the price of gold is moving in a relatively neutral range with a stronger bearish tendency if it returns to move below the $1700 support level. This may clear the way for the price to move towards stronger support levels, which gold investors may see as a buying opportunity. On the upside, the bulls still need to breach the resistance level of $1815 to change the current bearish outlook and start a bullish reversal on strong foundations.

The price of gold will interact today with the strength of the dollar and the extent of risk appetite, as well as the reaction from the announcement of inflation figures in the Eurozone, Federal Reserve policy decisions and statements of Chairman Jerome Powell.