Usually, the price of gold moves higher in times of uncertainty and risk-aversion, but this time the price of gold collided with the strength of the US dollar. This explains the weakness of the upward correction of the price of gold recently to the level of $1755 before it tested the support level of $1725 and stabilized around it at the time of writing. Confidence that the US economy will recover quickly from the pandemic supports the dollar. Investors have absorbed what was stated in the testimony of US Federal Reserve Chairman Jerome Powell in Congress and Treasury Secretary Janet Yellen about the health of the US economy.

Accordingly, the US Dollar Index rose to 92.30, affected by Powell's comments that the economic recovery has progressed more quickly than expected and appears to be strengthening. Powell also noted that the economic recovery is "far from complete," and stressed that the Fed will continue to provide the support the economy needs "as long as it is necessary."

In a similar performance to the gold price, silver futures contracts ended lower at $25.227 an ounce, while copper futures settled at $4.0795 a pound.

A report issued by the Department of Commerce showed a decrease in new home sales in the United States of America in February. The report said new home sales fell 18.2% to an annual rate of 775,000 in February after jumping 3.2% to an upwardly revised 948,000 in January. Economists had expected new home sales to decline 5.2% to the rate of 875,000 from the 923,000 originally reported for the previous month.

With a much larger-than-expected decline, US new home sales fell to their lowest level since standing at 698,000 in May.

The sharp decline in new home sales reflected a sharp decline in all four regions of the country, with new home sales in the Midwest leading the way down by 37.5%. Sales of new homes in the West and South declined by 16.4% and 14.7%, respectively, while sales of new homes in the Northeast decreased by 11.6%.

The report also showed that the median sale price of new homes sold in February was $349,400, down 1.1% from $ 353,200 in January, but up 5.3% from $331,800 in the same month last year. Estimates of new homes offered for sale at the end of the month were 312,000 homes, equivalent to 4.8 months of supply at the current sales rate.

Earlier this week, the National Association of Realtors released a report showing that US existing home sales also declined more than expected in February. The NAR Association said existing home sales fell 6.6% to an annual rate of 6.22 million in February after rising 0.2% to a downwardly revised 6.66 million in January.

Economists had expected existing home sales to decline 3.0% to the rate of 6.49 million from the 6.69 million originally reported in the previous month.

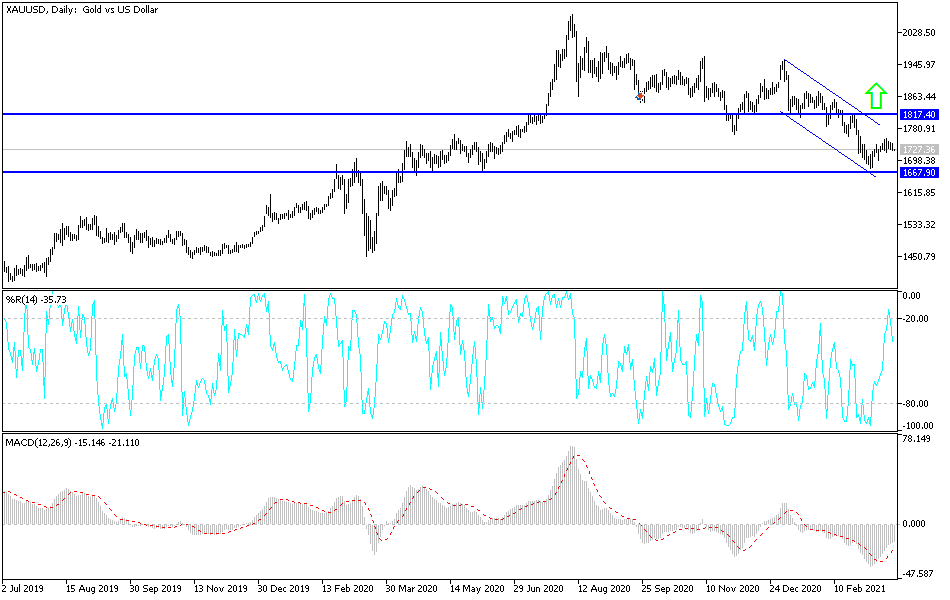

Technical analysis of gold:

The continued strength of the US dollar is still weakening the attempts of the price of gold to rebound higher, so the bears' control will remain for some time until the strength of the dollar stops. Buying gold from each downward level remains the best strategy, with the closest of those levels at $1710, $1685 and $1660. I confirm now that the bulls will control the performance in the event that the gold price returns to the periphery and above the level of psychological resistance of $1800. So far, the trend is neutral with a bearish tendency.

The price of gold will be affected today by the strength of the dollar and the extent of investor risk appetite, as well as the reaction from the announcement of British inflation numbers and PMI readings for the manufacturing and services sectors in the Eurozone, Britain and the United States. Then, the second testimony of US Federal Reserve Chairman Jerome Powell will be released.