The strength of the US dollar continues to put pressure on gold, which fell at the beginning of yesterday's trading to the $1707 support level, before settling around $1738 as of this writing. The sharp decline is still an opportunity for gold investors to consider buying and waiting for a bounce higher. Gold futures closed higher on Tuesday, following a five-session low that pushed prices to their lowest level in more than eight months.

Some analysts believe that gold's collapse may be over, especially now that the global forecast has shown some weaknesses. The sell-off in the global bond market could resume, but central banks are lining up to express their concerns about rising bond yields. In this regard, the Reserve Bank of Australia earlier in the week doubled its asset purchases, and European Central Bank Executive Board Member Fabio Panetta indicated on Tuesday that "the steeper nominal yield curve must be resisted" and that if the US Federal Reserve "clearly indicates its agreement with other central banks, then gold gains can easily be recovered."

Markets have focused on the movement in bond yields, which has affected the appetite for stocks and gold as it forces investors to evaluate the relative value of those assets against a system of richer returns and increased corporate borrowing costs. The Fed has suggested that the yield moves reflect the optimistic outlook for an economic recovery fueled by the vaccine program and the potential for additional fiscal stimulus.

The yield on the 10-year US Treasury remained below 1.5% for the second day in a row. Bond yield jumped to 1.6% last week.

Traders await a series of speeches from Fed officials this week, including that of Fed Chairman Jerome Powell on Thursday and the US February employment report on Friday, which will provide an update on the speed and direction of the nation's labor market recovery. Also, markets are awaiting further progress on the $1.9 trillion coronavirus relief bill. The bill will be discussed in the US Senate this week.

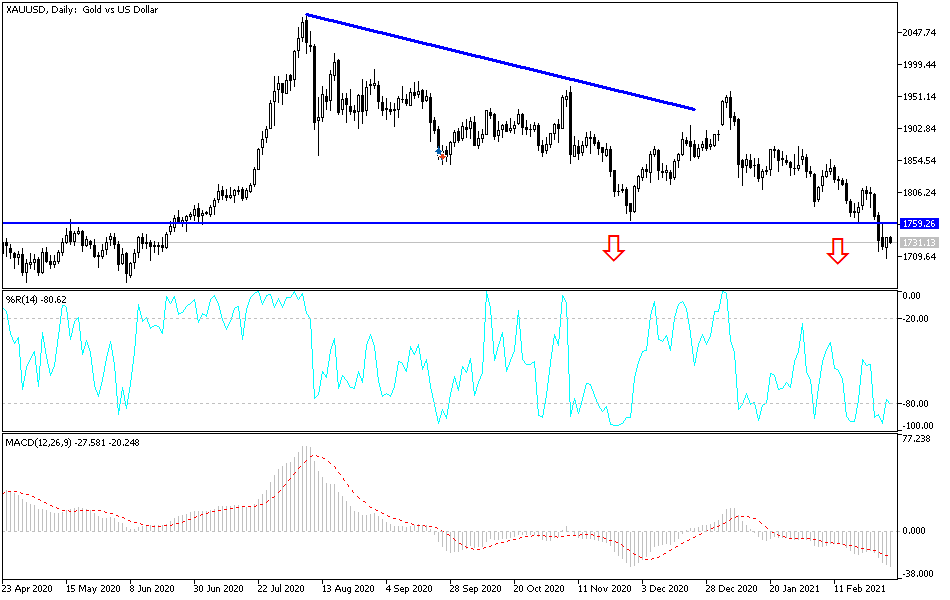

Technical analysis of gold:

The recent selling of gold pushed technical indicators to strong oversold areas, so I still prefer to buy from the lowest levels instead of being a seller. So far, the most appropriate buying levels would be $1718, $1696 and $1670. On the upside, as I mentioned before, the bulls will still need to breach the top of the $1800 resistance again, because it will pave the way for stronger buying deals and confidence that gold may re-test record high levels again.

The price of gold today will be affected by the level of the US dollar and risk sentiment, as well as the reaction to the announcement of the Service PMI reading from China, the Eurozone, Britain and the United States, and to the ADP survey.