Gold prices rose sharply during yesterday's trading, ending a 4-day series of losses, as the yields of long-term US Treasury bonds and government bonds in the Eurozone decreased and the dollar trimmed some of its recent gains. The price of gold today moved to the level of $1716 at the time of writing, after recent sell-offs had pushed it to the level of $1677, its lowest level in ten months.

Silver futures ended higher at $26.183 an ounce, while copper futures settled at $4.0085 a pound.

Bond yields declined in the Eurozone after data showed that the economy contracted by more than expected in the last three months of 2020 due to a sharp drop in household consumption. Accordingly, the GDP growth slowed by -0.7% on a quarterly basis, and decreased more than originally expected by 0.6%. On an annual basis, the GDP contracted by 4.9% in the fourth quarter.

The gold price will cautiously await the final approval of the new US administration plan. The final announcement will have a strong reaction to the US dollar and thus the price of gold and other financial markets.

Investors are betting that the $1.9 trillion set in the upcoming US government stimulus bill will help pull the world's largest US economy out of the distress caused by the coronavirus. There are also investors who are betting that the stimulus and an improving economy will lead to some inflation in the future. The US economic aid package, narrowly approved by the Senate on Saturday, provides direct payments of up to $1,400 to most Americans and extends emergency unemployment benefits.

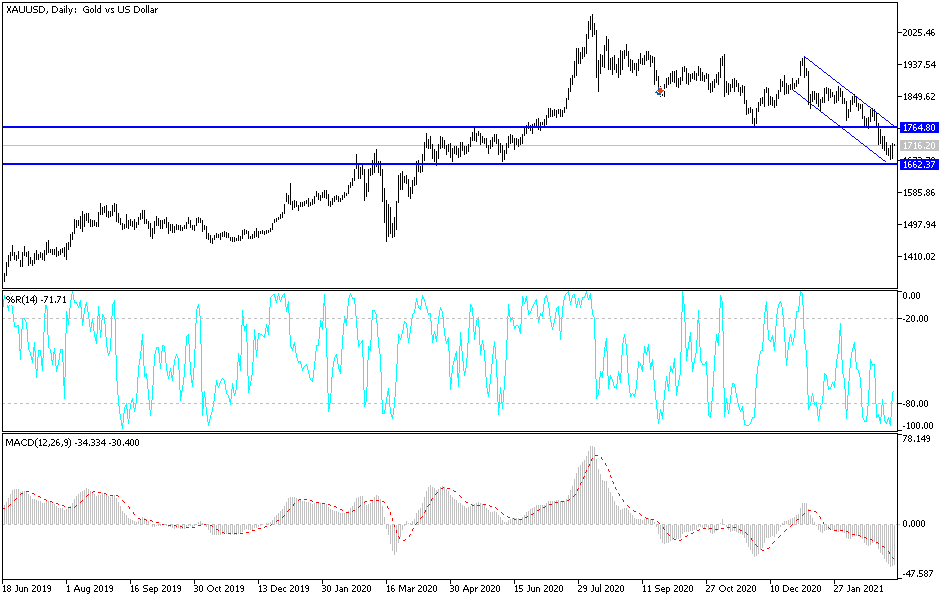

Technical analysis of gold:

Bearish momentum continues for gold, and there will be no return to a bullish performance without breaching the resistance level of $1800 again. Nevertheless, I still prefer to buy gold from every downside level and the closest buying levels are now $1675, $1635 and $1590. Many gold investors want to see the historical psychological summit of $2000, and this will not happen unless the global situation returns to what was in the first quarter of last year. The picture has now changed. There are many vaccines, and countries around the clock vaccinate their people in order to return to normal life in co-existence with the epidemic until it is finally eliminated. There are incentive plans that are still provided by governments and global central banks.