In the face of factors that increase gold's gains, the US dollar strengthened, which explains the weakness of gold's attempts to rebound higher during last week’s trading. The gains did not exceed the resistance level of $1745 before closing trading steadily around the level of $1733. The bears could not push the gold price below the support level of $1722. Along with the strength of the US dollar and with improved risk sentiment thanks to strong economic data in the US and progress in vaccination launches, stock markets gained new momentum.

Gold prices recorded their first weekly loss in three weeks.

Silver futures closed higher at $25.114 an ounce, while copper futures settled at $4.0680 a pound.

A report issued by the University of Michigan showed that consumer sentiment in the United States improved by more than previous estimates in March. The report mentioned that the Consumer Confidence Index for the month of March was revised upward to 84.9 from the initial reading of 83.0. Economists had expected the index to be revised up to 83.6. The US Consumer Confidence Index is much higher than the last reading for February at 76.8, marking its highest level since it reached 89.1 in the same month last year.

Before that, economic activity in the United States of America was announced to be faster than expected in the last quarter of 2020, and the official report last week showed that real GDP rose by 4.3% in the fourth quarter compared to the jump that was reported. Previously, that amounted to 4.1%. Economists had expected that the pace of GDP growth would not be adjusted.

The results indicated that the stronger growth than previous estimates primarily reflects an upward revision of private stock investment, which was partially offset by a downward review of non-residential fixed investment. Despite the upward revision, GDP growth in the fourth quarter still reflects a significant slowdown from the sudden rise of 33.4% in the third quarter.

The GDP growth in the fourth quarter reflected increased exports, non-residential fixed investment, consumer spending, fixed residential investment, and private stock investment. However, the decline in state and local government spending as well as federal government spending partially offsets the positive contributions along with increased imports, which are factored into the GDP calculation.

The report also showed a decrease in real GDP by 3.5% in 2020 compared to an increase of 2.2% in 2019.

Critical care doctors in Paris say that high rates of coronavirus infection may soon exceed their ability to care for patients in hospitals in the French capital, which may force them to choose patients who should be treated. The alarming warning of "catastrophic medicine" was sent out on Sunday in a newspaper opinion piece signed by 41 doctors from the Paris region. Published by Le Journal du Dimanche newspaper, this comes at a time when French President Emmanuel Macron is vigorously defending his decision not to completely close France again as he did last year.

Since January, the Macron government has instead imposed a nationwide overnight curfew and has followed suit with a series of other restrictions. But with the number of infections rising and hospital intensive care beds increasingly short, doctors have increased the pressure for a complete lockdown. Doctors expected that the new, softer restrictions imposed this month on Paris and other regions would not put the rapidly spreading epidemic under control.

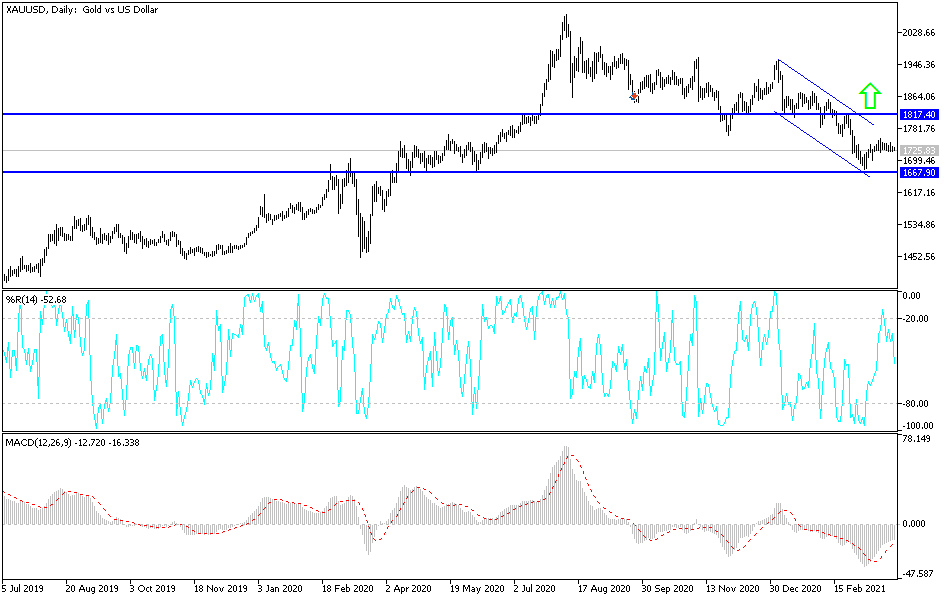

Technical analysis of gold:

On the daily chart, the movements of the gold price are still neutral and its gains are driven by the slowdown in many other global economies. The price of gold is waiting for the dollar's gains to stop, to return to its bullish start again. In return, the bears will gain control over the performance if the support level of $1710 is breached, which paves the way for the bears to move towards stronger support levels, the closest of which are $1685 and $1660. Despite the current downward pressure, I would still prefer to buy gold at every low level.

The bulls will not return to control the performance without the gold price moving to breach the psychological resistance level of $1800 an ounce.