The continued strength of the US dollar, supported by the pace of vaccinations and stimulus plans, contributed to bearish pressure of gold prices, which reached the support level of $1704, a 2-week low. The increase in US Treasury bond yields was an additional factor to put pressure on the gold price.

Today, US President Joe Biden will announce a stimulus plan, which could be worth up to $3 trillion, of which most will be spent on infrastructure.

As the number of new cases of COVID-19 infection increases in Spain, officials are urging people to prevent the epidemic from spiraling out of control by complying with restrictions on movements and gatherings for Easter. In this regard, Fernando Simon, who heads the epidemic response in the country, said that he believes that Spain can obscure the slow but steady rise while the vaccination campaign continues, as long as people remain disciplined during the Easter holidays.

Spain has reported an incidence of 149 cases per 100,000 people over a 14-day period. That was up from 129 cases per 100,000 a week earlier. This main epidemic index reached its peak of 900 at the end of January before easing amid restrictions on travel and gatherings. The index stabilized this month and started to rise in recent days.

The head of the CDC made an emotional plea for Americans not to let their guard down in the war against COVID-19, warning of a possible "fourth wave" of the virus as cases in the United States rose 10% over the past week. More than 93.6 million people, or 28.2% of the US population, have received at least one dose of the coronavirus vaccine, according to the Centers for Disease Control and Prevention. About 51.5 million people, or 15.5% of the population, have completed their vaccination. As for cases, the current rate of seven days of daily new cases rose in the United States during the past two weeks, from 53,670 on March 14th to 63,239 on Sunday, according to Johns Hopkins University.

The seven-day rolling average of new daily deaths in the US over the past two weeks fell from 1363 on March 14th to 969 on Sunday, according to Johns Hopkins University.

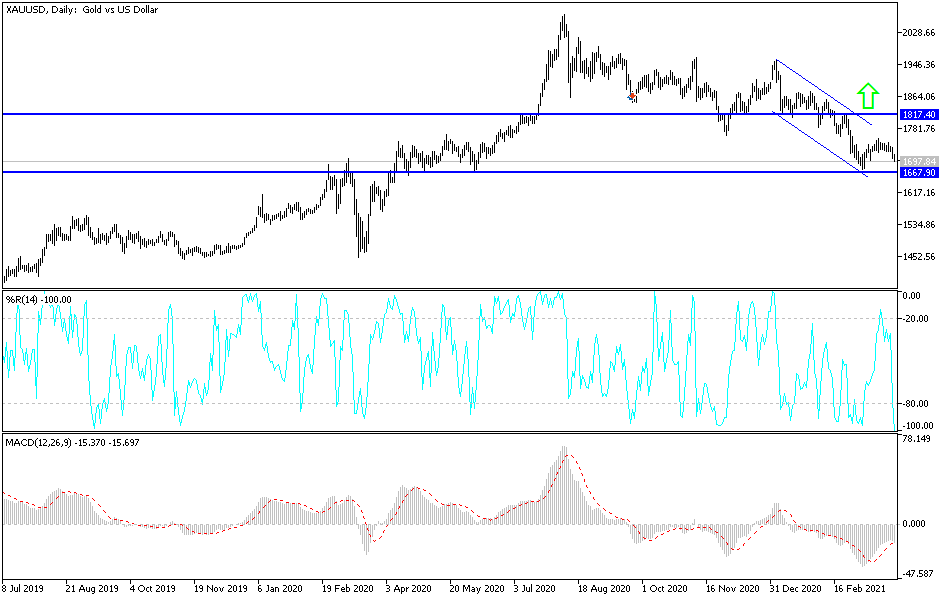

Technical analysis of gold:

A test of the support levels of $1692, $1680 and $1660 will be the most appropriate levels to buy gold at the present time and to wait for a rebound. These levels, according to the performance on the daily chart, will push the technical indicators to strong oversold levels. As I mentioned before, there will be no return to a bullish performance without first moving towards the psychological resistance level of $1800. Otherwise, the stronger bears will continue to dominate.

The price of gold will be affected today by the strength of the US dollar, US bond yields, the extent of investor risk appetite and the reaction to the announcement of US consumer confidence data.