The price of gold is trying to capitalize on the risk aversion that has been affecting global financial markets recently, but the recovery of the US dollar stopped its gains from crossing the $1745 barrier. The lowest price this week was at $1724 and stabilized around the level of $1735 at the time of writing. Gold is waiting for incentives to move in one of the two directions - the closest support level is $1710. The factors for gold's gains currently are the re-imposition of economic restrictions and closures to contain the increasing infections of mutants of the coronavirus, which threatens optimistic expectations for a global economic recovery amid global vaccinations.

The decline in Treasury yields also contributed to the rise in the price of gold, as the US Treasury yields decreased for the third consecutive day. The German benchmark 10-year bond yield fell to its lowest level in five weeks amid doubts about progress in reopening the global economy.

Several European countries, including Germany, France and Italy, have expanded restrictions related to the virus, amid a third wave of infections. For his part, the WHO chief said the recent increases in deaths and cases represent "truly worrying trends."

In the same performance as gold, silver futures ended lower at $25.231 an ounce, while copper futures settled at $40.0640 a pound.

A report from the Commerce Department showed that new orders for durable goods manufactured in the United States fell unexpectedly in February. The ministry announced that durable goods orders fell -1.1% in February after rising by an upwardly revised 3.5% in January. Economists had expected durable goods orders to rise 0.8% compared to the 3.4% jump in the previous month.

The data comes on the heels of the latest release of disappointing reports on retail, industrial and home sales, although the weakness is largely seen as a result of the recent severe winter storms.

Treasury Secretary Yellen said she supports borrowing to finance the $1.9 trillion aid package as it is temporary spending in response to a crisis. "But in the long term, we have to increase revenues to support permanent spending," she added. The Biden administration is considering raising the corporate tax rate to 28%, up from the current 21%, after the Trump administration lowered it from 35%. Tax increases for high-income Americans are also being considered.

Yellen and Fed Chairman Jerome Powell testified for a second day before a congressional committee on Wednesday, as part of congressional oversight of last year's $2 trillion emergency aid package. Powell reiterated that the recent jump in yields on 10-year Treasury notes, which rose from less than 1% at the start of the year to 1.6% on Wednesday, was mostly a sign of investor confidence that the economy is improving.

"It was an organized process," he stated. "I would be concerned if it wasn't an orderly process or if interest rates rose enough to curb borrowing and spending and slow the economy."

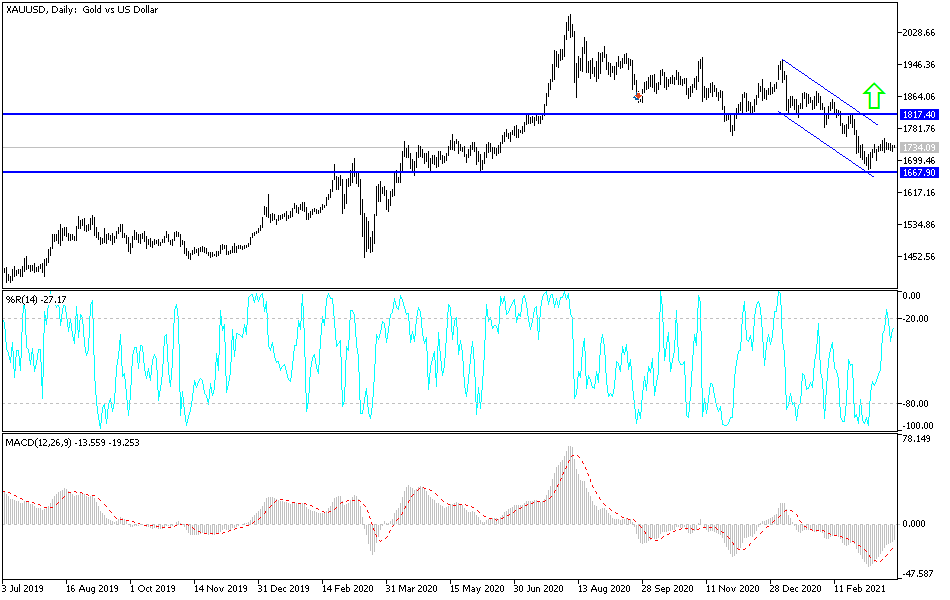

Technical analysis of gold:

On the daily chart, the price of gold is moving in a very narrow range, so I expect a price explosion in one of the two directions. Gold is most likely to rise, especially if the gains of the US dollar stop. The bullish retracement will occur upon a move towards the resistance levels of $1748, $1765 and $1800, the last of which would confirm a bullish trend. On the downside, the way is open for the bears to move to breach the $1700 psychological support again. I still prefer to buy gold from every downside.

The price of gold will be affected today by the strength of the dollar, the extent of investor risk appetite, and the announcement of the US GDP growth rate and the weekly jobless claims.