The strength of the US dollar continues to negatively affect the performance of gold prices, which fell to the support level of $1727 before settling around $1737 as of this writing. The move comes amid expectations of a possible decrease in the demand for the commodity from Turkey and in the stock markets to a certain extent. In the same performance, silver futures closed lower at $25.769, while copper futures settled at $4.1395 a pound. With the beginning of trading this week, the US dollar approached its highest level in four months against the lira after Turkish President Recep Tayyip Erdogan ousted Turkish Central Bank President Naji Aghbal.

The move came two days after Turkey's central bank raised its benchmark interest rate by 200 basis points to 19% to tame the high inflation rate. For its part, the central bank said in its statement that it "will continue to use monetary policy tools effectively in line with its main objective of achieving a permanent decline in inflation."

A report from the US National Association of Realtors said that existing home sales fell much more than expected in February, falling 6.6% to an annual rate of 6.22 million, after a slight rise of 0.2% to a downward revised rate of 6.66 million in January. Economists had expected existing home sales to decline 3% to the rate of 6.49 million from the 6.69 million originally reported for the previous month.

Elsewhere, and as was widely expected, China left initial loan interest rates unchanged for the eleventh month. The one-year rate remained at 3.85% and the five-year rate remained at 4.65%. Over the weekend, China appointed two new economists to the central bank's monetary policy committee. The duration is usually three years, and this appears to be the normal rotation. The People's Bank of China is not an independent central bank, and decisions of the Monetary Policy Committee require approval from the State Council.

Yesterday, Sinovac said that the CoronaVac vaccine to combat COVID-19 is safe and effective for children between the ages of 3 and 17. Geng Zeng, Sinovac's medical director, said at a press conference that the results were from early and medium clinical trials with more than 550 people. While the vaccine has already been allowed for use in adults in China, more tests are needed to see how it will work in children.

More than 70 million shots of the Sinovac vaccine have been given worldwide, including China. There were two cases of high fever in response to the vaccine during the trials, one in a 3-year-old participant and the other in a 6-year-old. Geng said the rest of the participants experienced mild symptoms.

The state-owned company Sinopharm, which has two COVID-19 vaccines, is also investigating the efficacy of its vaccine in children. They had said in January that they had provided clinical data to the organizers.

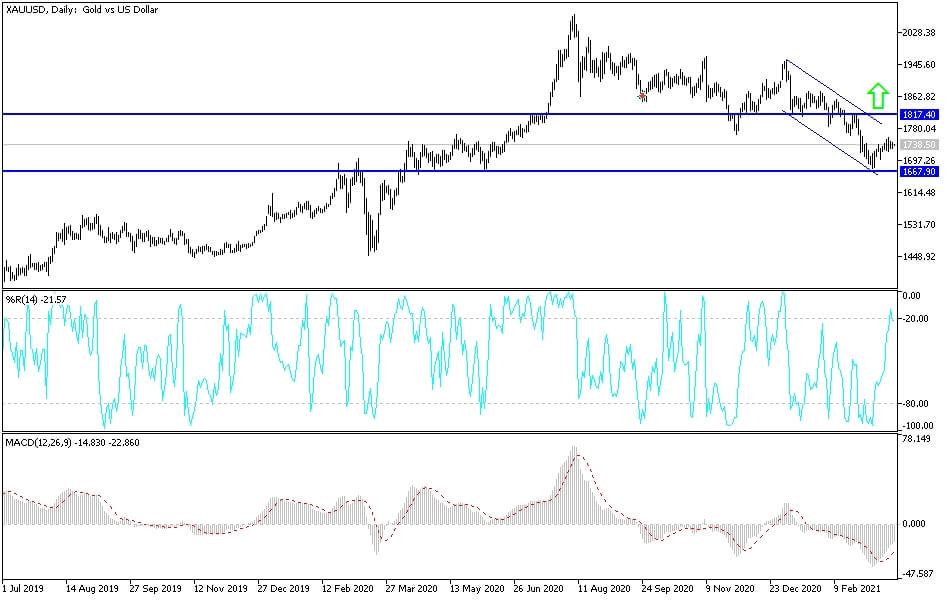

Technical analysis of gold:

On the daily chart, the price of gold is moving in a very narrow range for many recent trading sessions, and it is expected that a near price explosion will occur. Investors are only waiting for the push factors. The testimony of US Federal Reserve Chairman Jerome Powell and the statements of many officials of the bank’s Monetary Policy Committee, and the growth rate of the US economy will have strong effects in pushing the pair in one of two directions, and the tendency will be more bearish if the gold price returns to breach the support level of $1710. That will give the bears the opportunity to move strongly towards the next support levels of $1685 and $1660. I prefer to buy gold at lower levels and to prepare for the upward rebound. At present, the bulls lack sufficient momentum to launch towards the psychological resistance level of $1800, which confirms the strength of an upward correction.

I still prefer to buy gold from every downside and especially below the $1700 support.