Gold collapsed during last week's trading, breaking through the $1800 support level, which triggered profit-taking. This in turn sent the price of gold plunging to the support level at $1717, its lowest in eight months, before closing trading around the $1734 level. Forex traders are cautiously awaiting the opening of this week's trading to determine the fate of gold, which has turned into a strong bearish path. The question now is when will people stop selling gold and silver and realize that high inflation is not a one-off threat that the Fed will overcome by raising interest rates and tightening monetary policy. Peter Schiff explains: “They will do nothing. The dollar will collapse, and it is the mother of all gold headwinds. And so, at some point, it will happen. But in the meantime, they are simply creating more buying opportunities for people who have been really slow to pull the trigger to get the precious metal, and to obtain mining stocks.”

Powell was assured the markets again, "Don't worry, we're not going to tighten monetary policy for years." For some reason, people still think that higher interest rates hurt gold and silver, but they are optimistic about everything else. But the truth is, they are not. They are more optimistic about gold and silver than any of these other commodities...and this is a fact that no one wants to admit. Given the rise in interest rates, instead of raising rates and reducing the size of its quantitative easing program, the bank may increase the size of its quantitative easing program.

Therefore, February will be the worst month for gold since November 2016, which also witnessed a rise in interest rates.

Gold futures fell on the heel of rising US Treasury yields. The yield on US 10-year Treasury notes reached its highest level in 52 weeks, and is still a major factor contributing to the decline in demand for the safe-haven metal. The stronger-than-expected US economic data also added to concerns that the US Federal Reserve might withdraw the stimulus sooner than expected.

Meanwhile, there is speculation that US President Joe Biden's fiscal spending package will not be as large as the $1.9 trillion proposed.

The US Commerce Department said that personal income rose by 10% in January after rising by 0.6% in December. Economists expected personal income to rise 9.5%. The report also showed a major rebound in personal spending, which rose 2.4% in January after a revised 0.4% decline in December.

The MNI indices released a report on Friday showing a larger-than-expected slowdown in the pace of growth in business activity in the Chicago area in February. The report said that the Chicago business gauge of MNI indices fell to 59.5 in February after jumping to a more than two-year high of 63.8 in January.

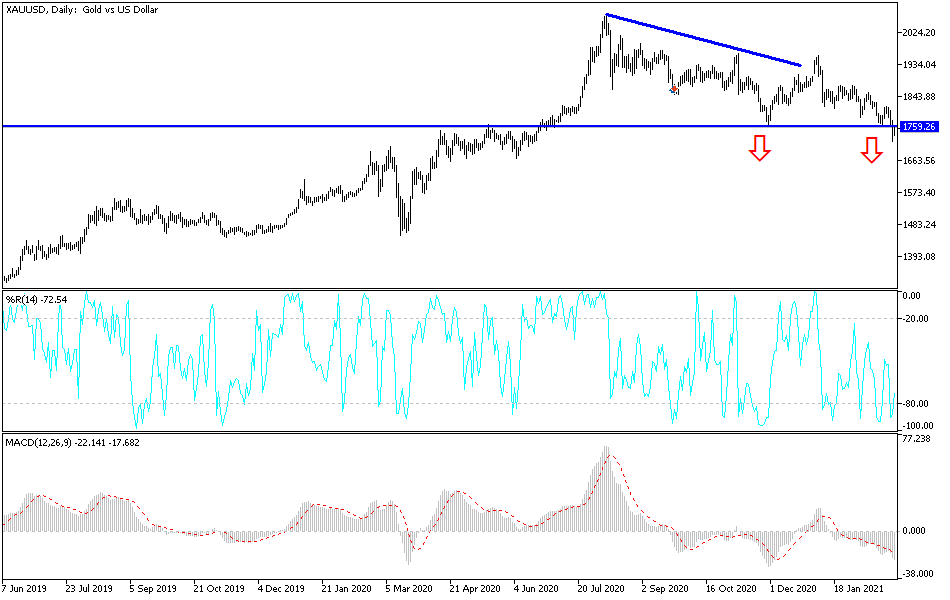

Technical analysis of gold:

Gold's recent losses pushed the technical indicators to strong oversold levels, so it is better to think about buying levels rather than preparing for stronger selling positions. Therefore, I would still buy from the support levels at $1722, $1700 and $1683. On the upside, bulls will not return to dominate the direction of gold without stability above the psychological resistance of $1800 again. The performance of the gold price will witness strong movements in light of the near passing of the US economic stimulus plans and the upcoming economic calendar, which will be led by the announcement of US jobs numbers.