During last week’s trading, gold's attempts to rebound higher after the price collapsed to the support level of $1677, a 9-month low, were weak. Attempts to correct upward did not exceed $1740 and the price closed the week’s trading steadily around the level of $1726. The decline in the price of gold came on the heels of a jump in US Treasury yields, with the yield on benchmark ten-year bonds rising again above the 1.6% level, its highest level in more than a year. The increase in revenues came after US President Joe Biden directed states to make all adults eligible for a coronavirus vaccine by May 1.

The vaccine news, along with the new US economic stimulus package of $1.9 trillion, sparked optimism about the economic outlook, reducing the appeal of bonds. Bond yields are moving in the opposite direction of prices. Yields saw further upside after a report from the University of Michigan showed that US consumer confidence improved by much more than expected in March.

The University of Michigan said its Consumer Confidence Index jumped to 83.0 in March after falling to 76.8 in February. Economists had expected the index to reach a reading of 78.5 points. With a much larger increase than expected, the US Consumer Confidence Index reached its highest level since it reached 89.1 in March 2020.

A separate report by the US Labor Department showed that US producer prices rose in line with economists’ estimates in February. In spite of that, the gold price rebounded but not with the same downward movement.

The European Central Bank appeared more confident that the worst was over. ECB Governor Lagarde agreed with the OECD's recent assessment that the large fiscal stimulus will have some positive spillover effects on the Eurozone. Growth can be helped through the trade channel, for example, while at the same time boosting inflation expectations. Lagarde indicated that the new forecast does not include the impact of the US financial package, but that the June forecast will include that. The ECB governor also realized that the European Recovery Fund will lag slightly behind US stimulus, but will be released soon.

The British economy contracted by -9% in January, which wasn't quite as bad as the -4.9% drop in output according to economic forecasts in a Bloomberg survey. The better performance was due to a slight decline in the services sector (-3.5% instead of -5.5%), a rise in the construction sector (0.9% versus -1.0%), and a smaller trade deficit (-1.6 billion GBP against 4.6 billion pounds). This was offset by a larger-than-expected 1.5% decline in industrial production, led by a -2.3% decline in manufacturing production. The implementation of new border controls under Brexit appears to have reduced the volume of trade.

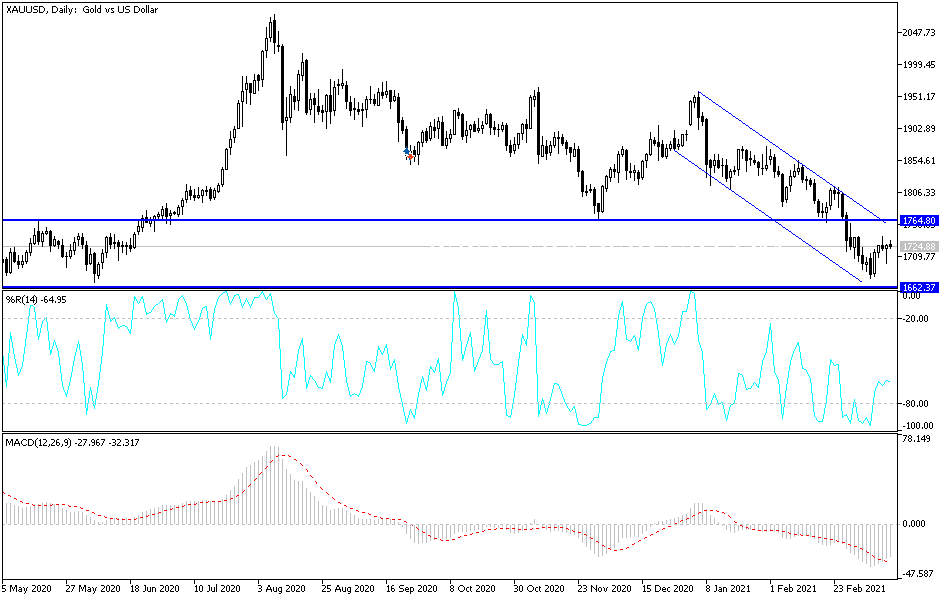

Technical analysis of gold:

The downward pressures on the performance of gold have not stopped yet and are still in place as long as the US dollar is strong. A retest of the $1700 support and below will increase the control of the bears and thus move towards stronger support levels, the closest of which would then be $1685, $1660 and $1645. The second and third levels are the most important to consider buying, awaiting the opportunity to rebound to the upside, because they will push the technical indicators to strong oversold areas. On the upside, there will be no return to a bullish performance without first penetrating the psychological resistance of $1800.

The price of gold will be affected today by the strength of the US dollar, bond yields, and the reaction to the announcement of the results of Chinese economic data, as well as the extent investor risk appetite.