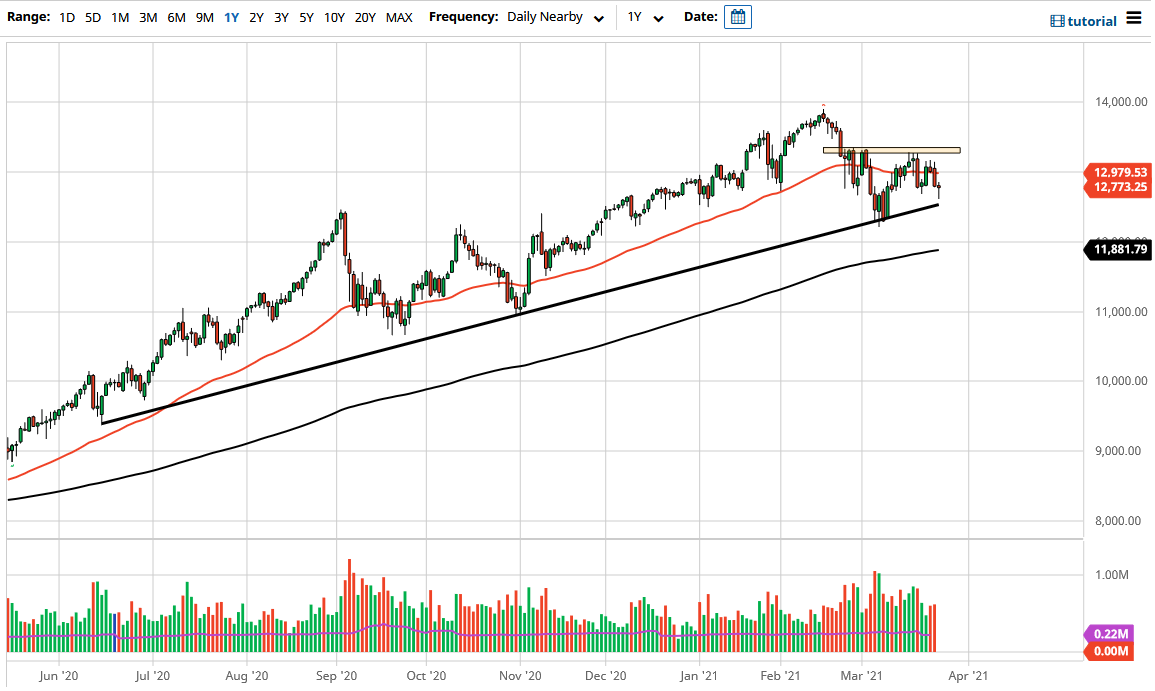

The NASDAQ 100 pulled back significantly during the course of the trading session on Thursday to reach towards a major uptrend line underneath. We have bounced significantly from there to form a bit of a hammer, so this suggests that the NASDAQ 100 is probably going to continue to bounce back and forth in this general vicinity, perhaps hanging around the 50 day EMA.

To the downside, if we were to break down below that uptrend line then I believe we would probably go to the recent low, and then maybe even down to the 200 day EMA. The 12,000 level underneath would be the next target where we should see a 200 day EMA support barrier come into play. On the other hand, if we break above the top of the candlestick then we are going to try to get back towards the 13,333 level, which has so far been massive resistance. Breaking above there would of course change everything but right now I do not know that we are quite ready to do so.

In the short term, I think this is probably going to be more noise than anything else. Ultimately, this is a market that will continue to see noisy behavior, and you should keep an eye on the interest rates in the 10 year note, because if it continues to see yields rise, that is going to be very toxic for this market. We simply are trading in the opposite direction of yields at this point, and as long as Apple continues to get bashed, that is going to work against this market as well.

It will be interesting to see whether or not we hang around this uptrend line, or if we try to make some type of move. I really think it comes down to the 10 year note more than anything else so by all means pay close attention to that. What happens going into the weekend might be a completely different question, because there are traders out there that will look at this as a value, but others will notice that we just made a “lower high.” If we were to break down below here, then we could end up making a “lower low”, which of course would be confirmation of the potential trend change.