The NASDAQ 100 has broken down significantly during the trading session on Thursday as the bond yields spiked yet again. This is in reaction to the speech that Jerome Powell gave, or specifically what was not in that speech. He did absolutely nothing to calm the bond market down, and therefore bonds got a huge push in the middle the day. There had been a building anticipation that Jerome Powell is going to step in and of the markets and save everyone, and it appears that perhaps everybody got a bit too exuberant and were asking for too much.

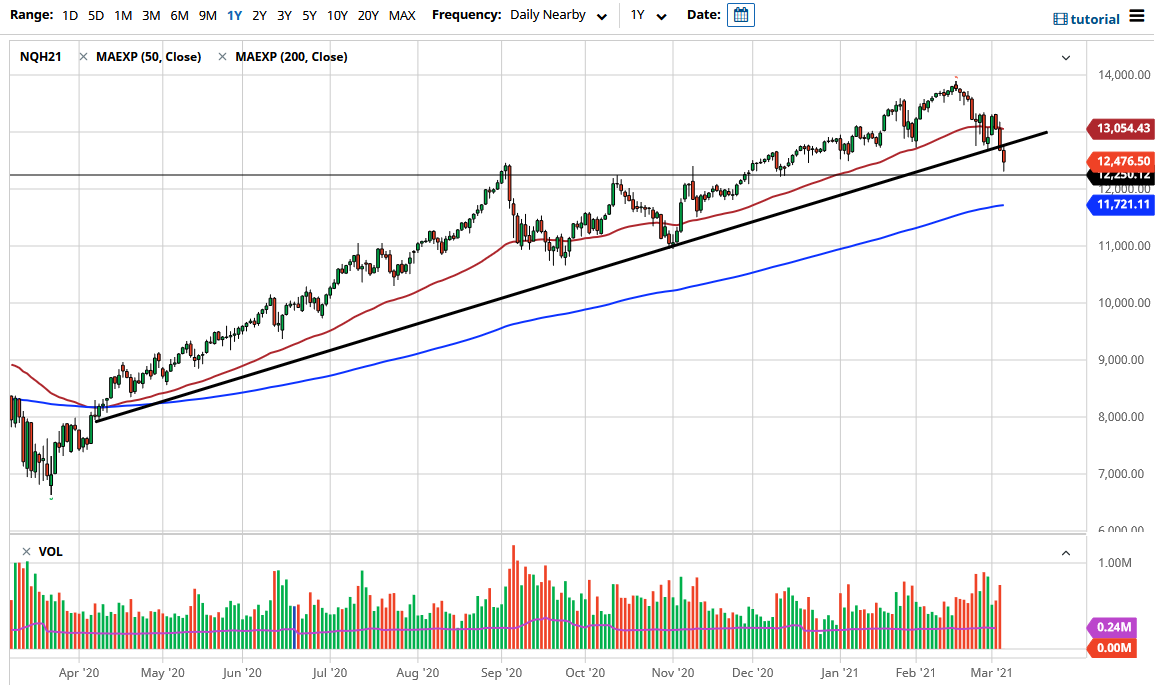

Just below, we have the 12,250 level which works for sideways support and resistance and have bounced from there. For what it is worth, we did break down below a significant trendline, so that is something to pay attention to as well. In other words, if we do not save it right now, this is a market that will more than likely go looking towards the 200 day EMA, perhaps slicing through the 12,000 handle.

On the other hand, if we turn around in recapture the uptrend line, it is likely that the market is going to go towards the 13,000 level, and then perhaps break back towards the 13,333 level, both areas that had been resistance in the past. That being said, this is a market that I think could be very noisy and dangerous during the trading session on Friday as we have the jobs number coming out. Because of this, I think that you need to be very cautious during the session and I think it is probably better off simply sit on the sidelines and wait to see what happens after the figure comes out. As for myself, if I do see this market break down below the 12,250 level, I might buy puts, but I would not be a seller of this market. The NASDAQ 100 has been begging for a correction for some time, so keep that in mind and also recognize that it is probably only a matter of time before the Federal Reserve does something to save everybody, that seems to be what they do over the last 12 or 13 years. With that being said, if we suddenly become bullish, I would be a buyer, but if we remain bearish, I am looking to express my opinion in the options market.