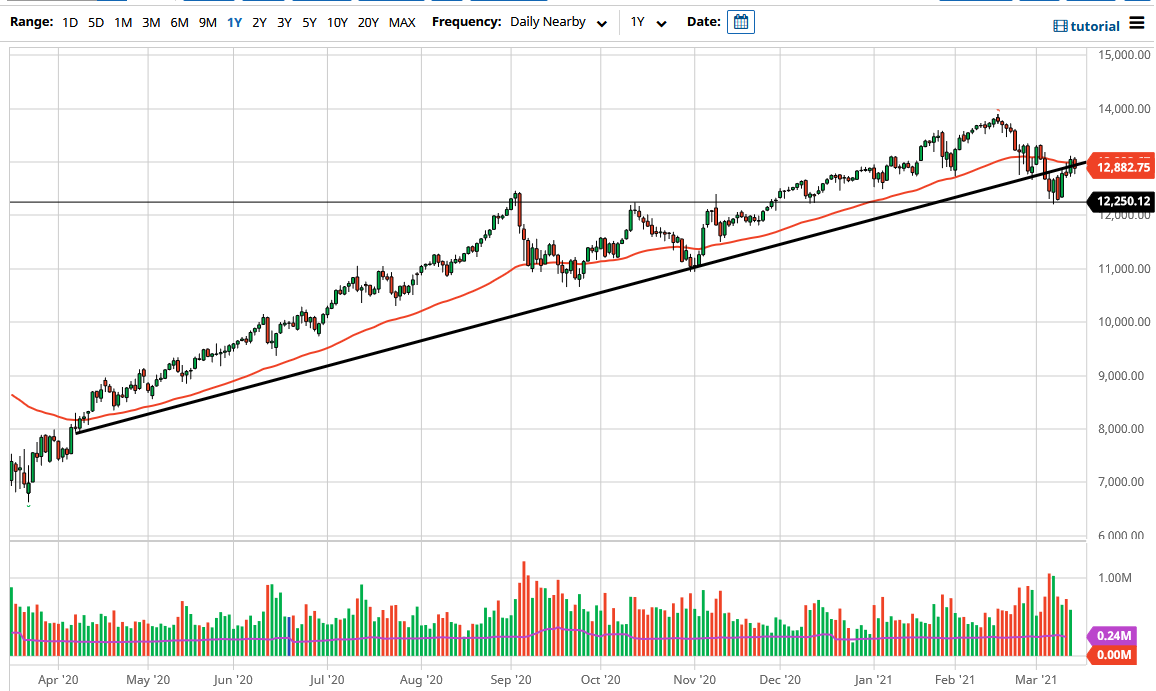

The NASDAQ 100 has been noisy all day on Friday as we are trying to figure out where we are going next. After all, the market is trying to rotate out of growth stocks into value stocks, and of course the NASDAQ 100 is chock-full of growth stocks. It is not to say that the NASDAQ 100 cannot go higher, it is just that it will more than likely continue to see a bit of sluggish behavior when compared to other indices in the United States. Nonetheless, it is worth noting that we are hanging about the 50 day EMA in a rather stubborn attitude, so I think really what we are looking at here is a market that is trying to figure out the bigger move.

To the downside, I believe that the 12,250 level is massive support, and we could pull back as far as that level without changing much. On the other hand, if we turn around a breakout above the highs of the last couple of sessions, we will more than likely go looking towards the 13,350 level. Clearing that level could send this market towards the 14,000 level, which is my longer-term target anyway. The stock market continues to run based upon liquidity and flooding of “cheap money”, so therefore as long as the Federal Reserve is out there to protect Wall Street, and let us face it they are, it is very likely that we will continue to see buyers given enough time.

If we were to break down below the 12,258 level, then we could see even more selling but at that point, I am going to be buying puts instead of trying to short the market. This is because markets do tend to turn around at the drop of a hat, so therefore I would rather just lose the premium that I paid for the option instead of trying to get too cute and lose a lot more. On the other hand, if we do break above the top of the last couple of candlesticks, then I would be looking to get towards the 13,350 level. At that point, I would even be looking to add to the position if we can continue to go higher. At that point, then I would ride the trade all the way up towards the 14,000 level.