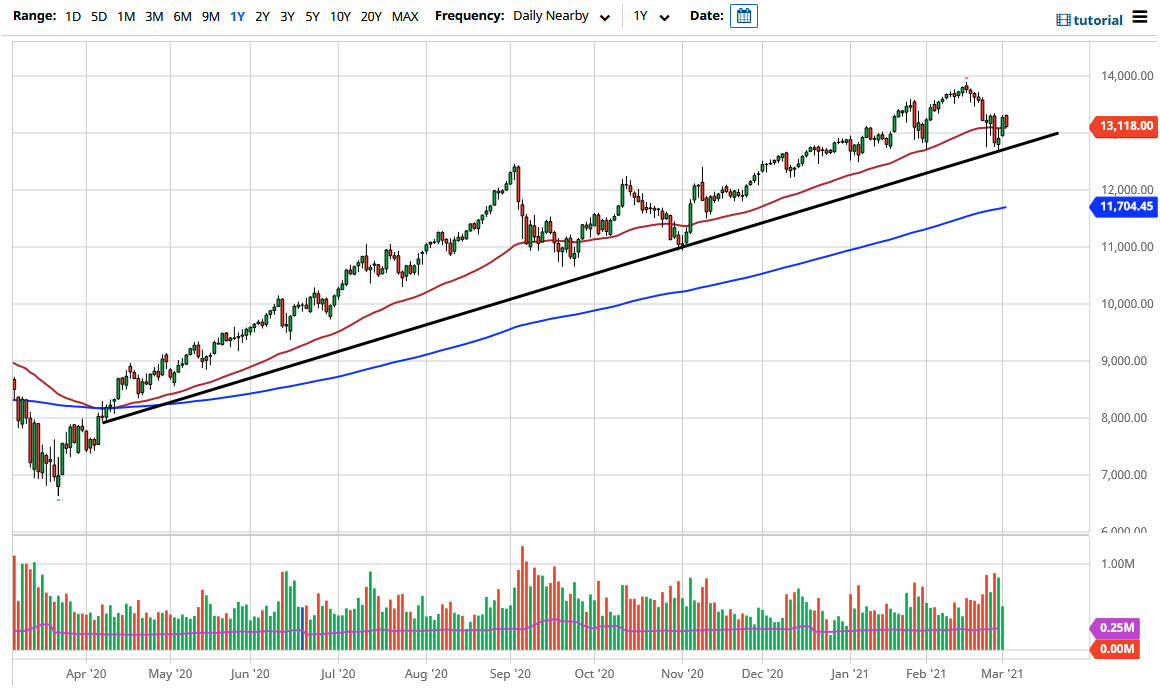

The NASDAQ 100 pulled back a bit during the trading session on Tuesday as we have lost 1.25%. We had gained so much during the previous session that this is simply a 50% retrace. Because of this, the market looks as if it is ready to hang around the 50-day EMA, which is flattening out. That suggests to me that we are going to continue to see a little bit of a lackluster performance, but eventually we will probably continue to see a lot of upward pressure due to the fact that the trend is most decidedly to the upside, and there is a major uptrend line underneath.

Stocks have been on a bit of a roller coaster ride, as the yields in various bond markets have been all over the place. What is interesting is that the bond yields fell during the session on Tuesday, as did the NASDAQ 100. Perhaps this is more or less a rotation trade, but at the end of the day there are still plenty of buyers underneath to keep this market afloat.

To the upside, if we can break above the highs over the last week or so, then I think the market can continue to go higher. I have this marked off as 13,333 above, and I think that if we were to break out above there, it is likely that the market will go looking towards the 13,800 level, followed by the 14,000 level. Longer term, I believe that we are still going towards the 15,000 level, which is a major figure based upon the idea of the “round number theory”, and I think we will eventually find our way there this year.

On the other hand, if we were to break down below the inverted hammer that formed during the trading session on Friday, then it could open up a much more negative leg down towards the 12,000 handle, where the 200-day EMA is likely to reach towards rather soon. It is not until we break down below the 200-day EMA that I am concerned about the NASDAQ 100, and at that point I would only be a buyer of puts, not necessarily one who would jump in and start shorting this market.