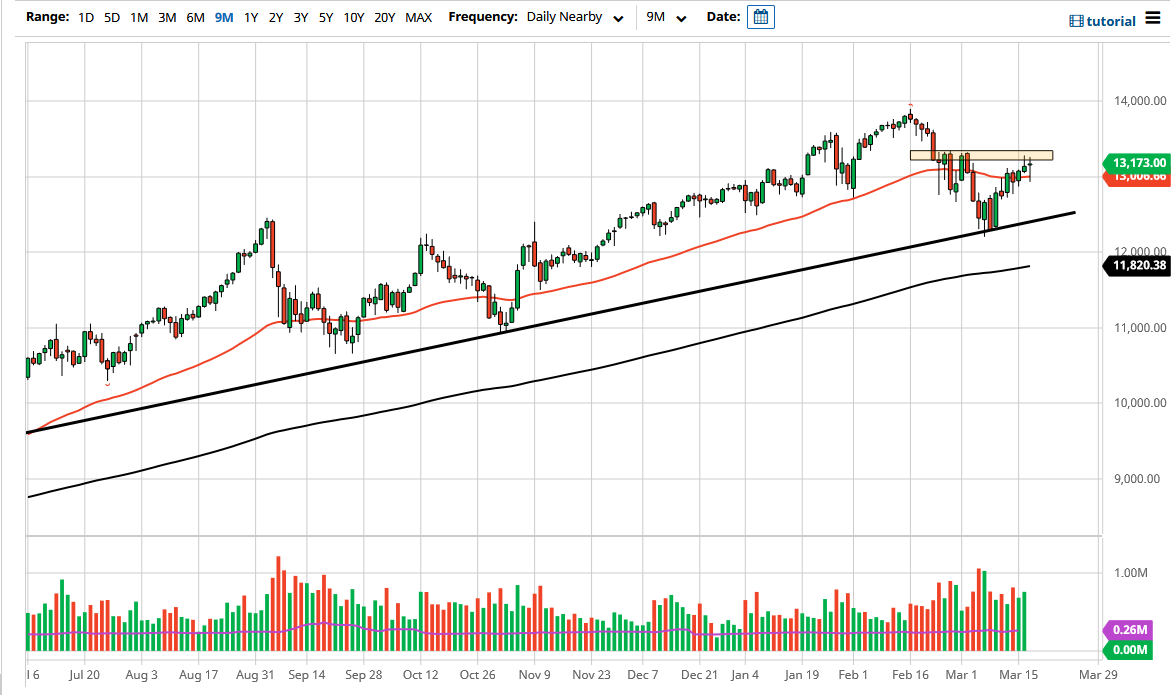

The NASDAQ 100 initially pulled back during the session on Wednesday to reach down towards the 50-day EMA at the 13,000 level to turn around and show signs of strength. By forming the hammer that we did, it suggests that we are ready to break out sooner rather than later, and if we can clear the 13,333 level, then it allows the market to go looking towards the highs yet again.

Recently, we have seen a bit of rotation in the markets, getting away from some of the massive gains that we have seen in the growth stocks that make up a huge portion of the NASDAQ 100. This does not mean that the NASDAQ 100 is going to start falling, just that it may underperform the S&P 500 and perhaps even the Russell 2000. It seems as if value is the play that people are looking for, and therefore certain stocks are going to outperform. You could also look at this as a market that will eventually go higher, so I like the idea of buying dips as long as we can stay above the massive uptrend that we have seen.

If we do break down below the candlestick for the trading session on Wednesday, then it could open up a move towards the trendline, where I would expect to see even more support near the 12,500 level. If we break down below there, then I would be a buyer of puts, but I would not risk a lot of money due to the fact that the Federal Reserve has a nasty habit of stepping into the markets to protect them.

We currently have a question as to whether or not the Federal Reserve is going to be able to control bond yields, as they have not been able to control them as of late. If the yields in the bond market continue to explode to the upside, that means that the “risk-free rate of return” is much more attractive and people may start to clip coupons on bonds instead of buying stocks. Nonetheless, we are still in an uptrend, and that is the prism in which you need to look at this market, because every time we have tried to short the market over the last 13 years it has been tenuous to say the least.