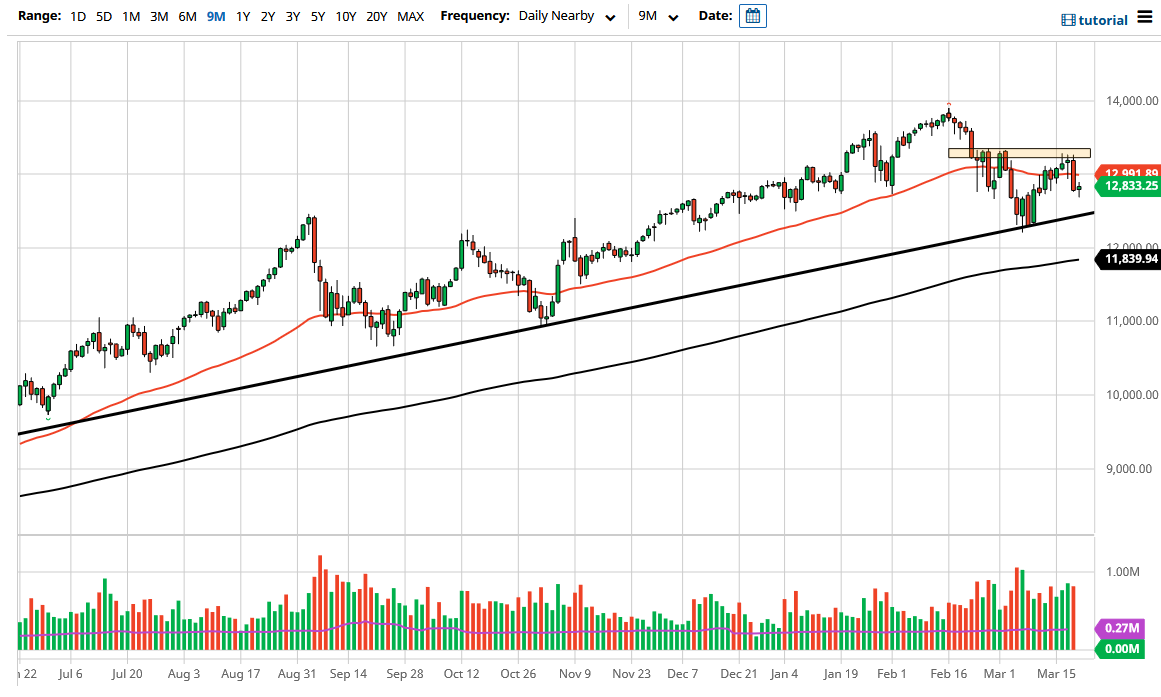

NASDAQ 100 traders were somewhat stabilizing during the trading session on Friday as we saw a hammer form heading into the “quad witching” hour. It looks as if the market is trying to find its legs again, and it is also worth noting that although we had initially seen a surge in US 10-year yields, they pared some of the gains later in the day. That does suggest that perhaps we are going to continue to see a lot of strength in this market over the longer term, but it is worth noting that the bond markets have spooked the stock traders more than once.

The uptrend line underneath will continue to offer support, so I think really what we are looking at here is a scenario where we see a “buy on the dips” type of attitude. At this point, the 13,333 level also offers major resistance, so if we can break above there then it is likely that we could go looking towards the 14,000 handle. Do not get me wrong; I do not think it is going to be easy, but eventually it is likely that the markets will find a reason to go higher.

If we were to turn around and break down below the bottom of the uptrend line, then it is likely that we will see a drop down towards the 200-day EMA. If we can break down below that uptrend line, then I am a buyer of puts, not necessarily somebody that would short this market. In general, I think the one thing that you can count on is a lot of noise, as the market has been showing just how difficult trading is going to be as we come out of the pandemic. With the yields rising at the same time, it suggests that people are worried about putting money to work in the stock market, but yields rising for the correct reasons, and other words the economy waking back up, and the long run will probably work hand-in-hand with stock markets. Keep in mind that we are currently rebalancing a lot of our portfolios out there, and that makes the NASDAQ 100 little bit more vulnerable than some of the other indices in the US.