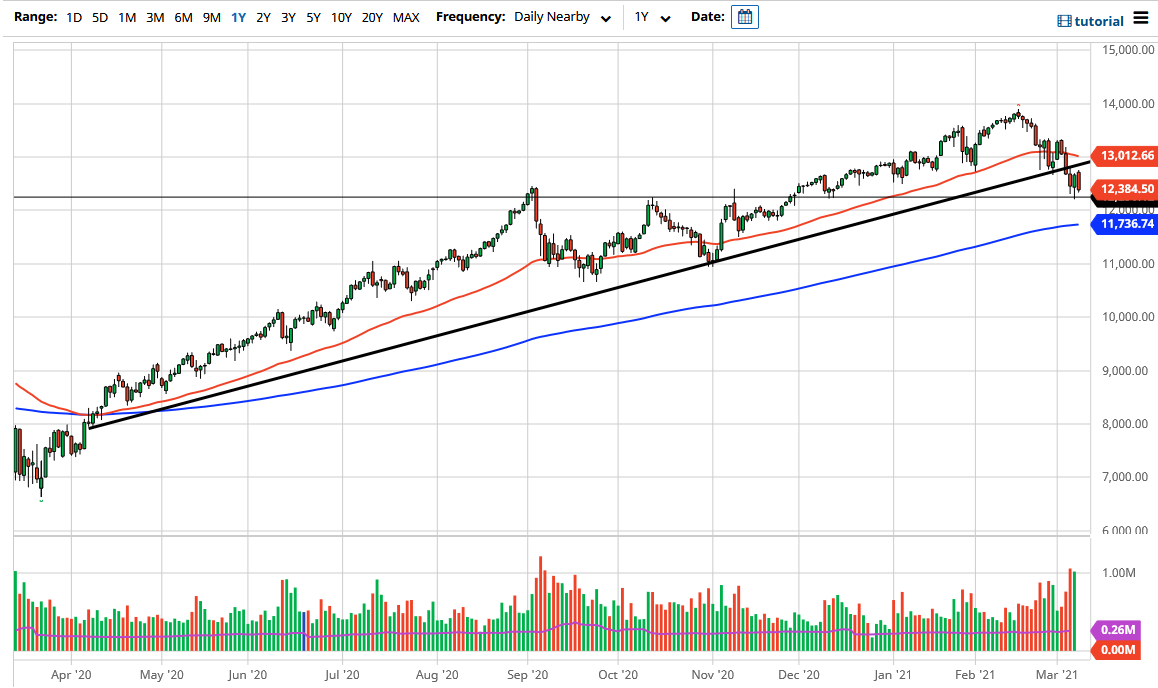

The NASDAQ 100 broke down significantly during the trading session on Monday to wipe out all of the gains from the Friday session. The market looks as if it is ready to test a major support level in the form of 12,250, and if we were to break down below that level, it is likely that we will go looking towards the 4000 handle which is the large, round, psychologically significant support level underneath. Breaking down below that then opens up the possibility of a move towards the 200-day EMA.

The 200-day EMA is presently sitting at the 11,736 handle, and breaking down below there would be a trend change for some traders, and I think it would only open up fresh selling. At that point, I would not be a seller of this market, rather I would be a buyer of puts, because as you know the stock market has a nasty habit of turning around quite rapidly. The fact that we are closing towards the bottom of the candlestick does not bode well, and I think the NASDAQ 100 might be in a bit of trouble here.

On the other hand, if we can recapture that previous uptrend line, then I believe that we could turn things around. But there has been a major rotation out of growth and into value, which works against the NASDAQ 100 as there are so many highflyers in the index. Because of this, I think that what we are seeing here is an attempt to break things down, but I do believe that given enough time there should be plenty of value hunters willing to get into this market due to the fact that it is only a matter of time before the Federal Reserve does something about those higher interest rates. They claim they are going to do anything yet, but we have seen more than once in the past that they are willing to step in if things get out of hand, and while they are not quite out of hand yet, we are most certainly getting closer to that timeframe. This is a pattern that we have been in for at least 13 years. We will see some type of major breakdown followed by a longer-term rally based upon liquidity measures.