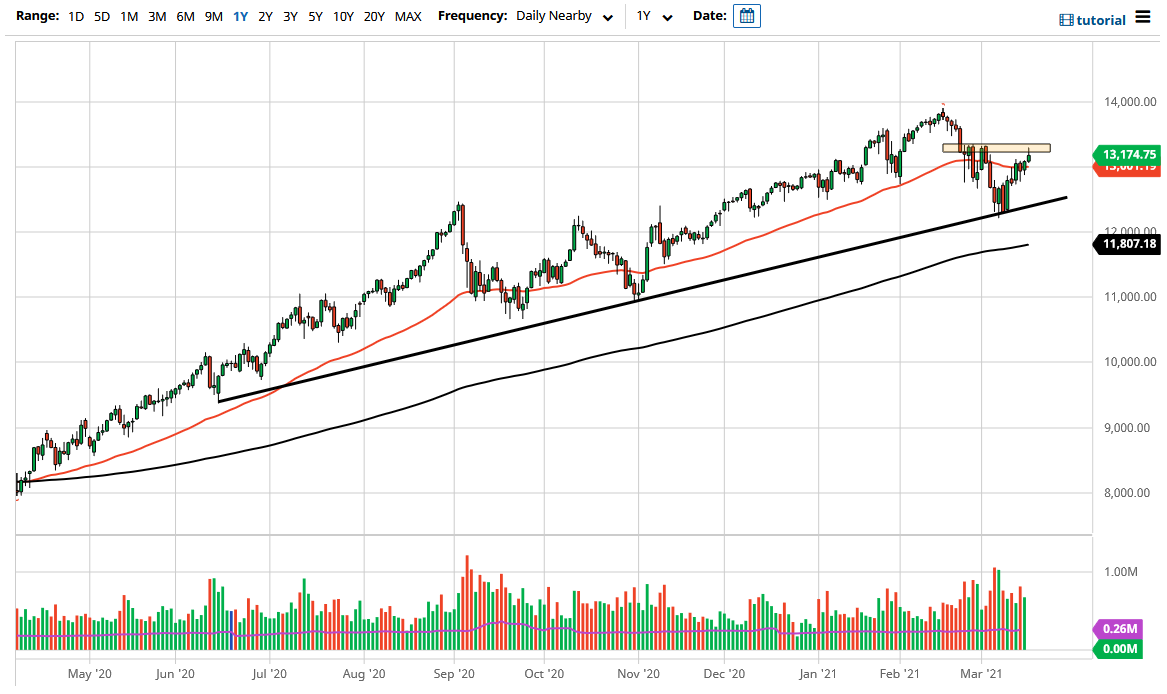

The NASDAQ 100 rallied a bit during the trading session on Tuesday to reach towards the 13,333 level. That is an area that has offered significant resistance in the past, so it is not a huge surprise to see that we could not slice through there. However, if we were to do so, that should send this market much higher, perhaps reaching towards the 14,000 level.

The Wednesday session is going to be crucial because of the FOMC meeting and, more importantly, the statement and press conference. Because of this, the volatility will be massive later in the day, as traders are concerned about yields in the bond market. If the Federal Reserve is willing to do something about those yields, perhaps driving it down, then it would help markets. On the other hand, if the FOMC statement and press conference really does not say much about the yield situation, that may cause a bit of a panic in the stock market.

Recently, we have seen traders jump into the value stocks instead of high growth stocks like we see in this index. I do like the idea of finding value on dips, although it appears that the Dow Jones Industrial Average will probably offer more in the way of returns, but I still believe that this one will rise over time as well. Furthermore, if we see yields drop, that will be a bit like rocket fuel for this market, because everything will go up, not just the stocks that have been rallying as of late.

To the downside, I see the 50-day EMA and the 13,000 level as support. If we were to break down below there, it is likely that the uptrend line that sits underneath will probably keep this market somewhat supported, assuming that we even get down to that area. Because of this, I like the idea of finding short-term pullbacks to show signs of support and taking advantage of that action as we have been in an uptrend for so long. I do not think that the market is ready to turn around and take off to the downside, and even if we did, I would simply be looking for a reason to find some type of supportive action underneath. A little bit of patience could go long way if we were in that scenario.