The NASDAQ 100 has fallen initially during the trading session on Friday but then turned around to rally again as US stocks in general rally. The NASDAQ 100 is probably going to be a bit of a laggard when it comes to US indices though, as higher yields will make people nervous about owning growth stocks and go into value. The NASDAQ 100, by its very definition, is an index that features a lot of growth companies, and therefore has been a favorite of traders for several years.

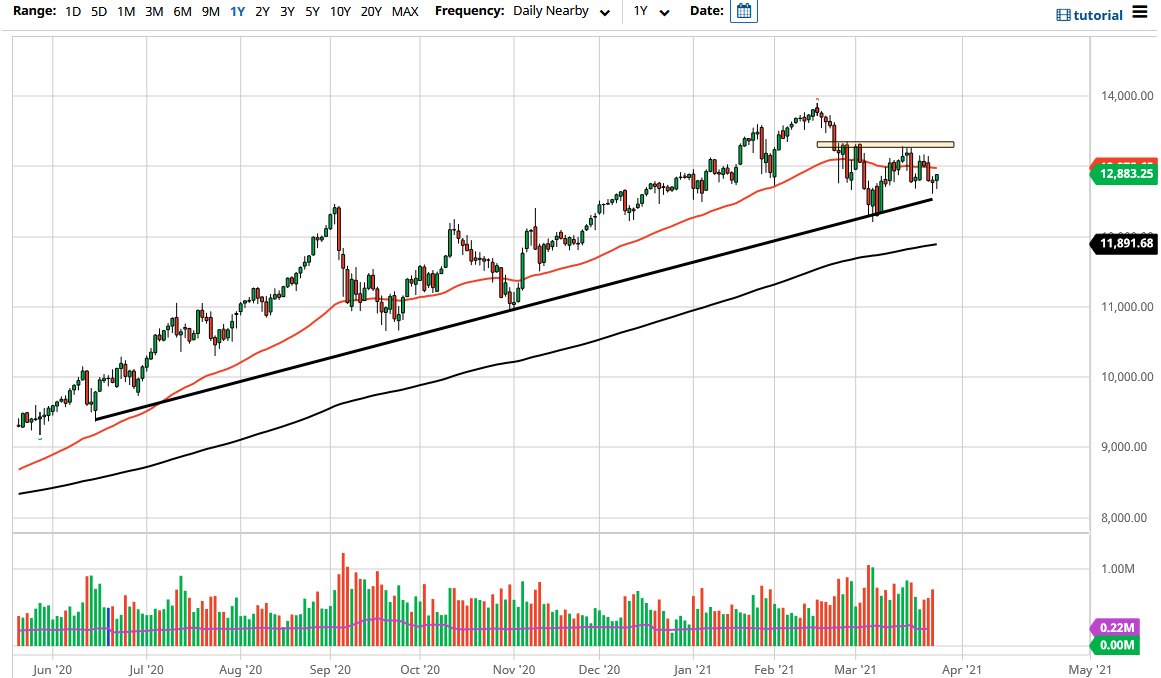

There is an uptrend line just below that has been important, and we are sitting just below the 50-day EMA. That being said, we are closing towards the top of the candlestick for the trading session, which is a very bullish sign. The 13,000 level above could be a bit of a barrier, but I do not think there is too much to it. Beyond that, if we were to break above the 13,333 level, then it is likely that we would go looking towards the highs again. On the other hand, if we were to pull back from here, then I think there will be plenty of buyers based upon that uptrend line, and the recent price action.

The 200-day EMA underneath would be supportive based upon a longer-term chart, but if we break down below the uptrend line, I would not be a seller, rather I would be looking to buy puts, as it at least would keep your risk somewhat limited. Until then, I look at dips as buying opportunities, but I also recognize that you need to keep your position size relatively small, as there is so much in the way of volatility.

Long term, I do believe that stocks will continue to rise based upon the fact that the Federal Reserve continues to flood the markets with liquidity. However, rising bond yields have recently been a major problem, so the question is whether or not we can see a calming down of the bond market. If we do, then I think even elevated rates will eventually be looked beyond, and therefore could be a way to look at potential growth as well, thereby making stocks interesting again. Regardless, this is a market that every time you have tried to short it over the last several years, you had to be very quick. With that being the case, I buy puts, I do not short the market when it is bearish.