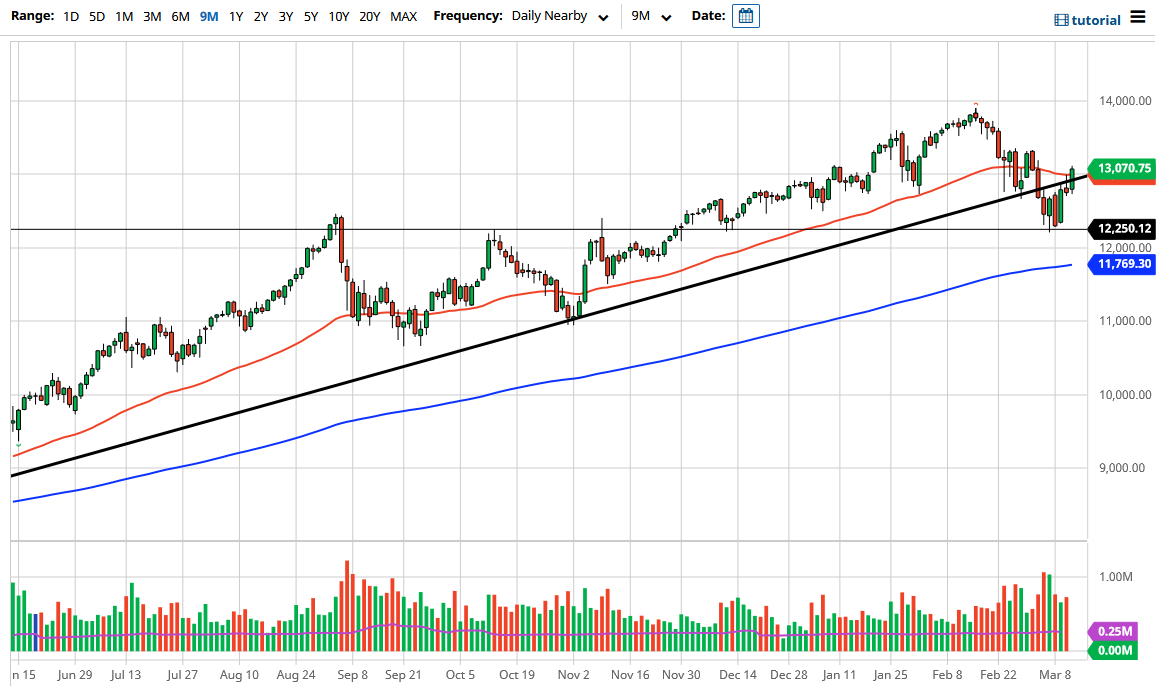

The NASDAQ 100 has rallied significantly during the trading session on Thursday to break not only above the shooting star for the previous session but has also broken above the 50 day EMA. That being said, market is showing signs of real resiliency by doing so, so now that we have recovered the way we have, it is likely that the market could go looking towards the 13,350 region. If we can break above there, then the market is likely to go looking towards the 14,000 level.

To the downside, I believe that the 12,250 level has offered itself as support, and now looks to be a bit of a “floor in the market” that we will be paying attention to. That is an area that had been important over the last couple of days, therefore I think a certain amount of “market memory” comes into play there. The market certainly looks as if it is ready to go looking towards the 14,000 level yet again, but it is going to take some time to get there. If we can break above the 13,350 level, then I think we will accelerate to the upside.

You should keep in mind that there has been a bit of rotation in the stock market as of late, and that may be part of what has been working against the NASDAQ 100. However, as the yields have dropped in the United States, it looks as if the market is ready to rally in general, as the risk appetite comes back to the marketplace, not only in the NASDAQ 100, but it is also mean other assets as well. All things being equal, this is a market that I is one that will continue to offer value on dips.

As far as selling is concerned, I have no interest in doing so but if we break down below the 12,250 level it could be a buyer of puts depending on what the premium would be. All things being equal, it is very difficult to short this market, because it is a market that can turn around at the drop of the time, just as we have seen over the last 24 hours. Because of this, I will be looking to buy dips, or a breakout above that 12,350 level as it occurs.