The NASDAQ 100 has been the darling of Wall Street for quite some time, but certainly we see traders out there trying to rotate into value stocks, which works against the NASDAQ 100 as the major growth companies in the technology sector will continue to weigh upon the NASDAQ 100. From a technical analysis standpoint, this is a very ugly set up and it does suggest that we are going to pull back.

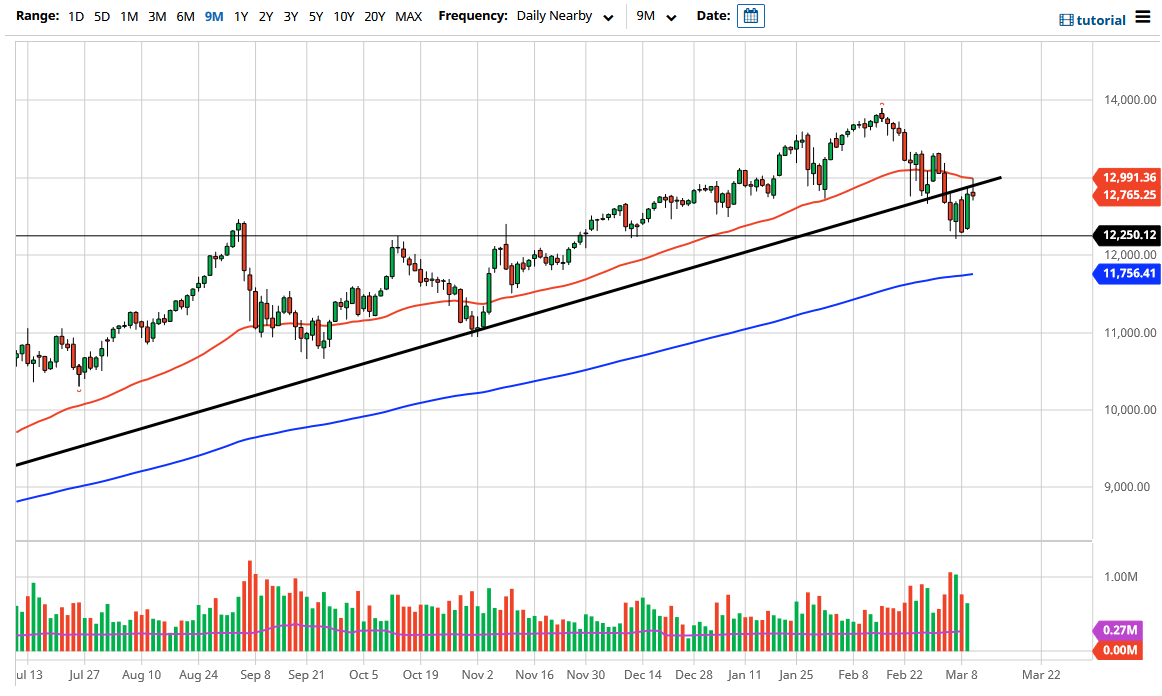

Needless to say, forming a shooting star for the trading session does not look good, and it does suggest that perhaps we are going to drop from here. If we break down below the bottom of the candlestick, then I think it is very likely that we will see the market try to jump back into the previous consolidation area, perhaps even drop as low as the 12,250 level. That level has been supportive as of late, but it is also worth noting that we have retested the previous uptrend line again, and even broke above it before failing. The 50 day EMA is sitting just above, and I think that comes into play as well. The fact that we pulled back from there, or perhaps even more importantly the 13,000 level, suggest that there is still a lot of ugliness out there to be had.

I do not necessarily think that we are going to collapse, I just think that the NASDAQ 100 will continue to lag the rest of the stock market. That being said, I believe that a lot of traders are starting to do a “pairs trades”, going long the S&P 500 while shorting the NASDAQ 100. If we do continue to see traders focus on the idea of the market reopening, then that tends to favor certain stocks that you would find in the Dow Jones Industrial Average, and the S&P 500. With that in mind, the NASDAQ 100 is probably going to lose favor for this next few weeks, but I do believe that eventually the market goes higher. If we did break down below the bottom of the daily candlestick, I may be tempted to trade the options market, perhaps buying puts, but that would be a short-term set up at best. On the other hand, if we break above the top of the candlestick for the session on Wednesday, that would be a very bullish sign as it would break several forms of resistance it could open up a move towards the 13,333 level.