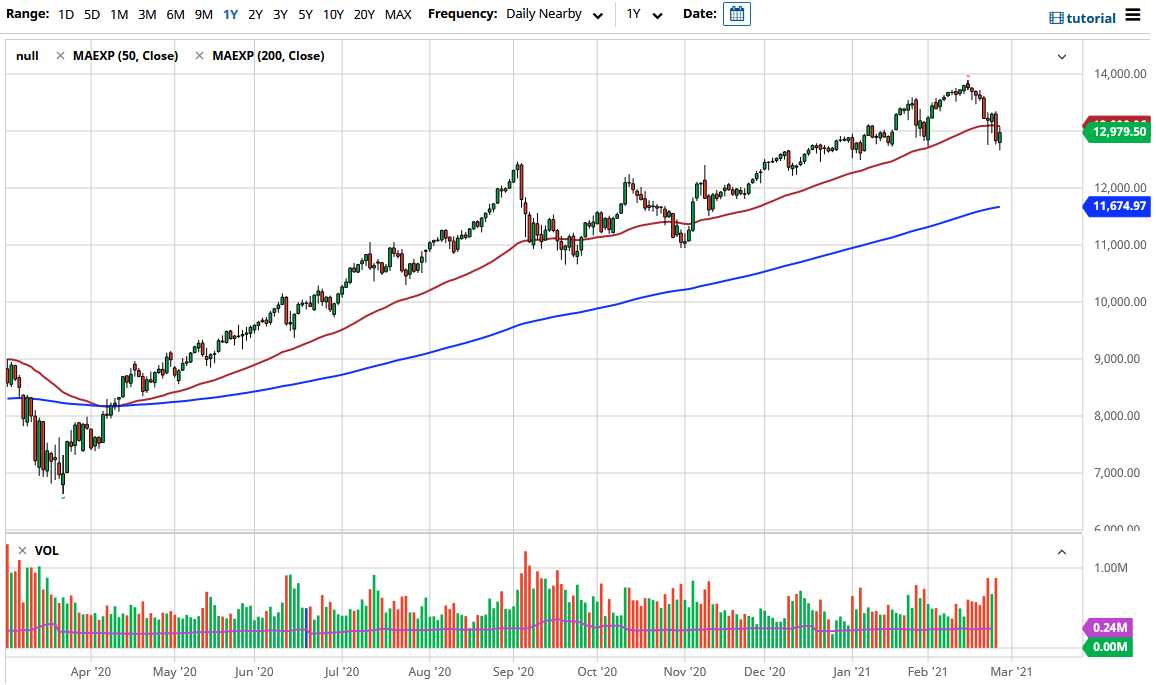

The NASDAQ 100 rallied a bit during the trading session on Friday as we have seen a previous sell-off because of so much havoc in the market. It looks as if the 13,000 level is a bit of a magnet for traders, as the 50-day EMA sits just above there. This is a market that I think will continue to be very noisy, and we could continue to see bearish pressure based upon what is going on in the market. As long as yields continue to rise, that could work against the value of this particular index.

The market has been very bullish for a very long time and the Federal Reserve will do what it can to save Wall Street from a significant sell-off. In other words, if we do get a massive selloff, the Federal Reserve will almost certainly open up the spigot yet again. I do think that it is only a matter of time before we recover, and even if we did sell off at this point, I have absolutely no interest in trying to short this market, because every time you have tried to short the NASDAQ 100, it has been a handful of losses. If I were to try to get short of this market it would probably be through the options market because at least we can get away from unlimited losses.

Even if we do break down from here, I would not anticipate a move below the 200-day EMA, or even the 12,000 level for that matter. In general, I anticipate that what we are seeing is a pullback that has been long overdue, and with yields rising it is more or less going to be the excuse that everybody needed. I still believe that we will go looking towards the 14,000 level, and then eventually further to the 15,000 level which should be a bit of a psychological barrier for most traders to deal with. Although the action lately has been a bit more bearish than the past several months, the reality is that the chop has worked in both directions, meaning that there is still a lot of interest in trading this market from both buying and selling perspectives. In other words, I do not know how much that this market has changed longer term.