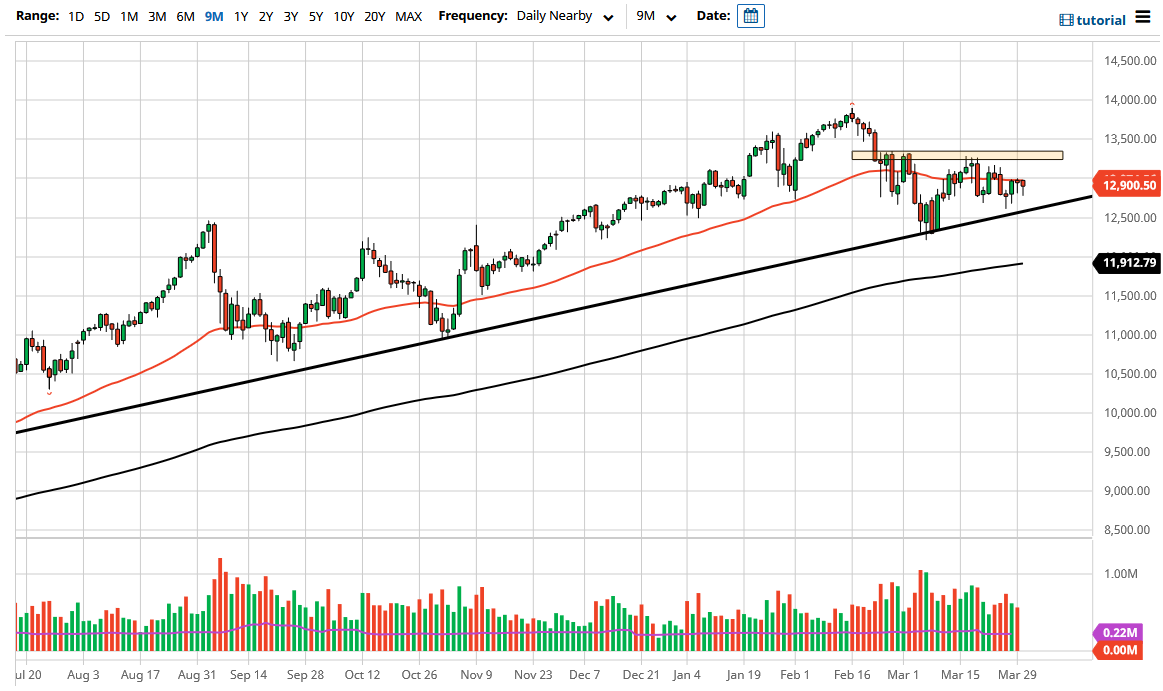

The NASDAQ 100 has fallen a bit during the trading session on Tuesday, as the 50 day EMA has caused a bit of resistance. That being said, the market also turned around from the lows and rally again. That being said, the market is continuing to be very noisy, due to the fact that bonds continue to show strength in yields, so that has been rather hectic and therefore it has had people running back and forth from the bond market to risk appetite. The NASDAQ 100 of course is all about risk appetite, as there are a lot of traders looking to get involved in these growth stocks in a low yield environment. However, the biggest problem the NASDAQ 100 has is that a lot of these growth companies are highly levered, meaning that debt becomes much more expensive for them.

Furthermore, if the yields continue to climb, it gives traders an opportunity to pick up gains without risking much. It gives traders another choice, instead of jumping into the stock market and risking losses. At this point in time, this is a market that is still very much in an uptrend though, and I think that is something that you need to pay close attention to. The candlestick for the trading session on Tuesday is a bit of a hammer, just as the Monday candlestick was and the Thursday candlestick was as well.

To the upside, the 13,333 level is an area where we have seen a lot of selling pressure, so if we can break above there then I believe that the NASDAQ 100 goes much higher. That being said, the 50 day EMA is going sideways and hovering near the 12,900 level, so I think we continue to see a lot of jittery trading, but it should be noted that the Tuesday session was end of quarter rebalancing, so a certain amount of inflows will come into the market on Wednesday, and I think will probably see a positive session. Whether or not we can break out to the upside is a completely different question, but I think in the next 24 hours we will probably have a little bit of buying pressure for those of you to get involved for short-term trade. Once we break above the 13,333 level, then I think the market has the possibility of going back to the highs again.