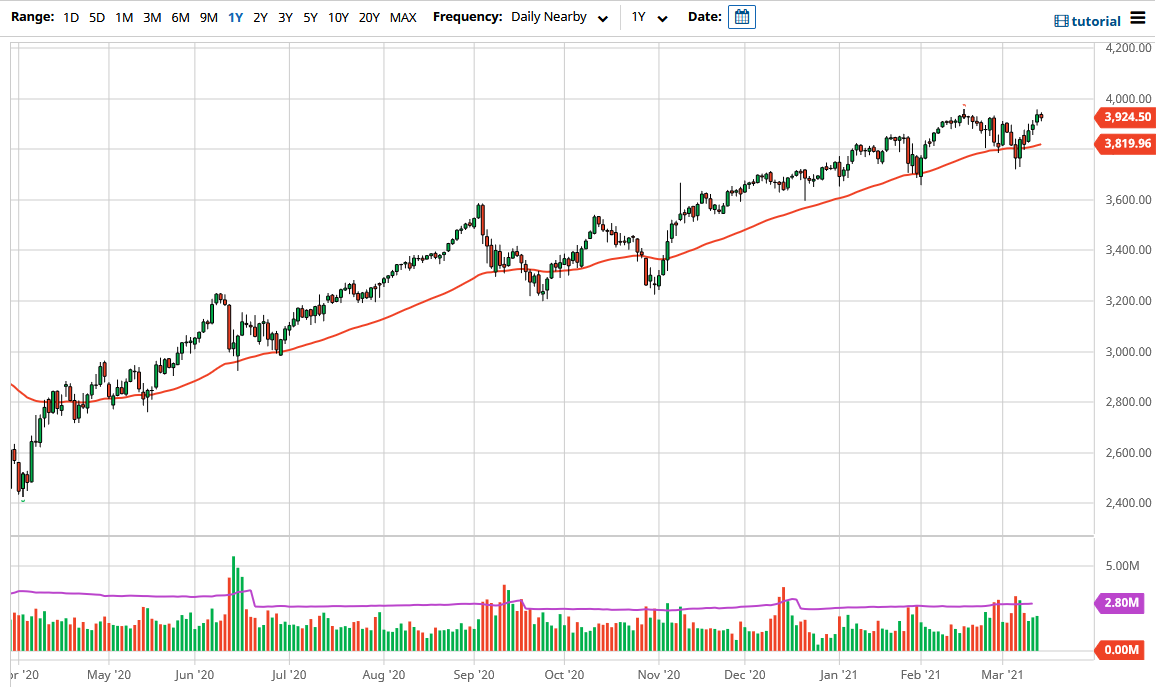

The S&P 500 has gone back and forth during the trading session on Friday, as we are hanging just above the 3900 level. It is worth noting that the futures market is rolling over into the next contract, so as we go through the rollover things could get a bit funky. Nonetheless, we are still in a very bullish trend and I think we are eyeballing the 4000 level as a target. If we can break above there, then we could start the next leg higher.

This should not be a huge surprise, due to the fact that we had consolidated between the 3200 level and the 3600 level underneath and measuring that 400 point move from the breakout suggests that we are going to go to the 4000 handle. I do believe that we get there sometime next week, but we may have a short-term pullback in order to build up the necessary momentum. That is okay, because the market cannot go straight up in the air forever, despite what the Federal Reserve would have you believe. The 50 day EMA underneath has offered more or less a dynamic uptrend line, so it does suggest that we could continue to go higher.

I have no interest in shorting, but if we did break down below that bounce from late last week, then I think you could start to look at the idea of buying puts, but I would not be a trader that was short this market, because the market has is horrible habit of ripping the faces off of short-sellers every time they get confident. As far as US indices are concerned, it is difficult to sell them, so I either buy puts or I am on the sidelines/long. This is the only three positions I am willing to take when it comes to indices in the US, because if we fall more than about 5%, somebody is going to step in and protect everybody. Whether it is the plunge protection team or the Federal Reserve directly, we have seen more than once that the market is not allowed to fall very far. Do not get me wrong, I recognize that the market is completely ignoring the economic reality most of the time, but that is the world we live in.