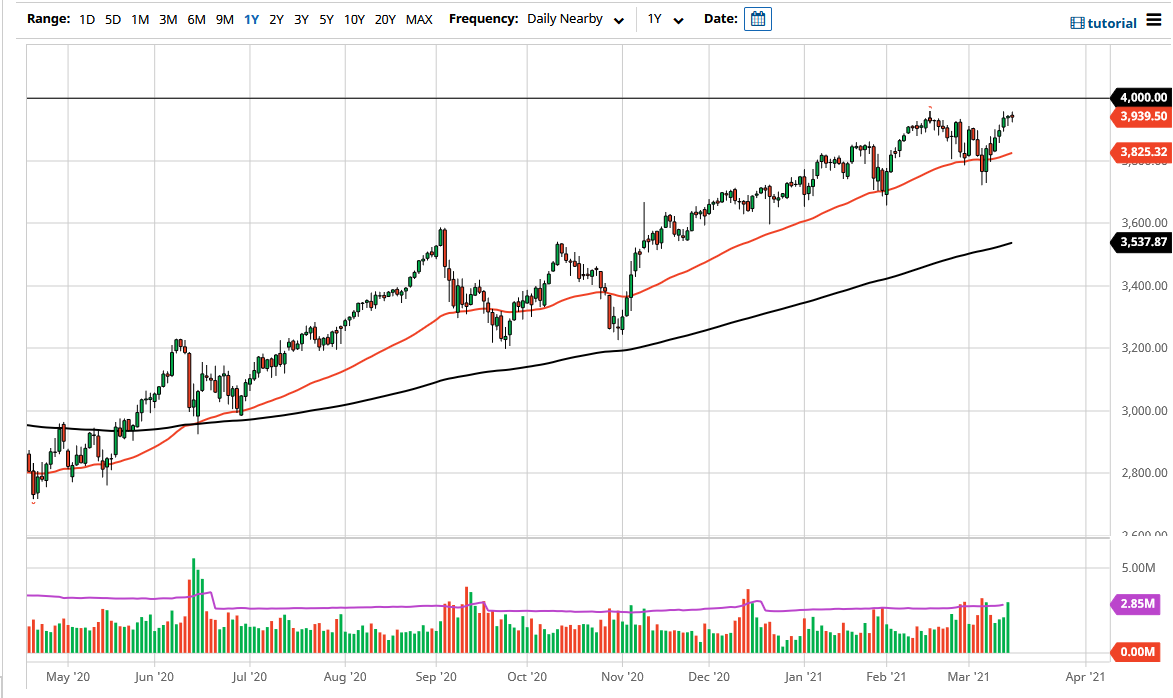

The S&P 500 has done very little during the trading session on Monday as the market has essentially tread water as we wait for Jerome Powell on Wednesday. The S&P 500 continues to look at the 4000 level as a major barrier, and quite frankly it is likely that we will see the markets hesitate a bit as we are sitting just below there.

I think all things being equal, the market is likely going to continue to see the FOMC meeting on Wednesday as crucial, but perhaps even more importantly they will be paying close attention to the statement afterwards. The market is paying close attention to the idea of whether or not the Federal Reserve will be getting involved in the bond markets. After all, a lot of people are concerned about the rising yields and whether or not the Federal Reserve is going to let them run. After all, higher yields to weigh upon the stock market, and that is going to be the major driver of stock markets over the course of the week. Between now and the end of the day on Wednesday though, it is probably going to be very choppy.

Another thing that could be driving the market sideways is the fact that a lot of stock traders are starting to rotate their portfolios, getting away from growth and heading into value stocks. This tends to favor the Dow Jones Industrial Average, but the S&P 500 does have a certain amount of value in it, so I think we are still very much in a bullish trend, with the 50 day EMA underneath offering plenty of support. At this point, if the Federal Reserve is going to step in and push yields down, that will be the catalyst to send this market above the 4000 handle and continue to push the S&P 500 much higher.

If we were to break down below the most recent swing low at the 3725 handle, then it could open up a move down to the 3600 level where the 200 day EMA would come into play. At this point, I think that it is only a matter of time before value hunters would probably get involved. Nonetheless, I think this is a market that is going to chop around between now and Jerome Powell’s question and answer session.