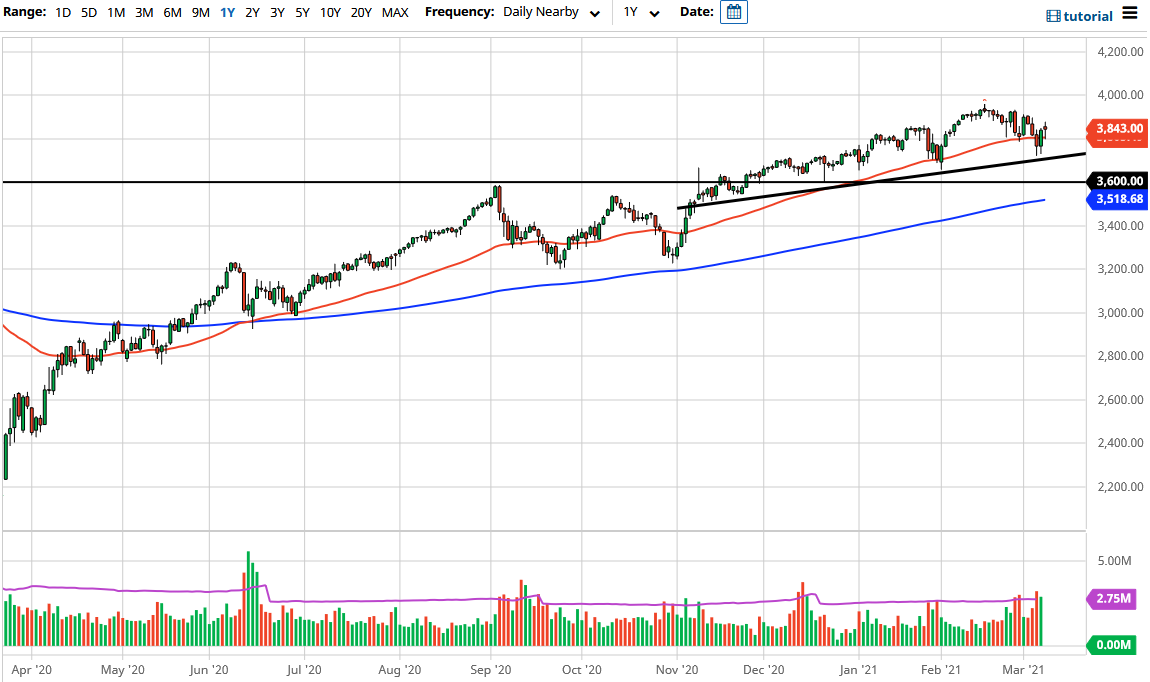

The S&P 500 was all over the place during the training session on Monday, as the volatility continues to pick up. The 50-day EMA sits just underneath, and that is offering support at this point. Given enough time, we will probably see this market continue to try to grind towards the 4000 handle, but let's be honest here: this is a market that is facing a lot of headwinds, especially when it comes to the bond yields offering 1.6% and above on the tenure.

However, the market also tends to be rather resilient, and we have certainly seen that over the last 24 hours. Yes, this is going to end up being a slightly negative day, but it still shows promise and I think that it is only a matter of time before we see another push to the upside. If we can break above the highs of the trading session on Monday, then we will go looking towards the 3900 level, possibly even the 4000 level, which is the longer-term target that I think most traders are aiming for. At that point, I would anticipate a lot of profit-taking, simply because of the psychology involved.

The uptrend line underneath should continue to cause a significant amount of support, and it is worth noting that the S&P 500 has outperformed the NASDAQ 100. However, the Russell 2000 has been the big star as of late, so there is a lot going on under the surface that you will not necessarily see in the major indices. Nonetheless, I have no interest in shorting this market and would be a buyer of puts if we did see some type of significant breakdown, but I think it is more likely than not that the uptrend line will hold, and if not, then the 3600 level would be next. After that, we have the 200-day EMA that is also reaching towards the 3600 level, so I think that we have plenty of support underneath to continue pushing this market to the upside. At this point, I am a buyer of dips, but I also recognize that you need to pick your spots and probably keep your position size somewhat reasonable.