The S&P 500 initially pulled back during the trading session on Wednesday but then turned around to show signs of strength ends the treasury auctions went fairly well in the United States. Both the 10 and the 30 year auctions went much better than anticipated, sending yields higher in the US. This of course is good for stocks because it does not work against the idea of gains in the stock market. After all, you will not have people out there earning a “risk free rate” of positive return.

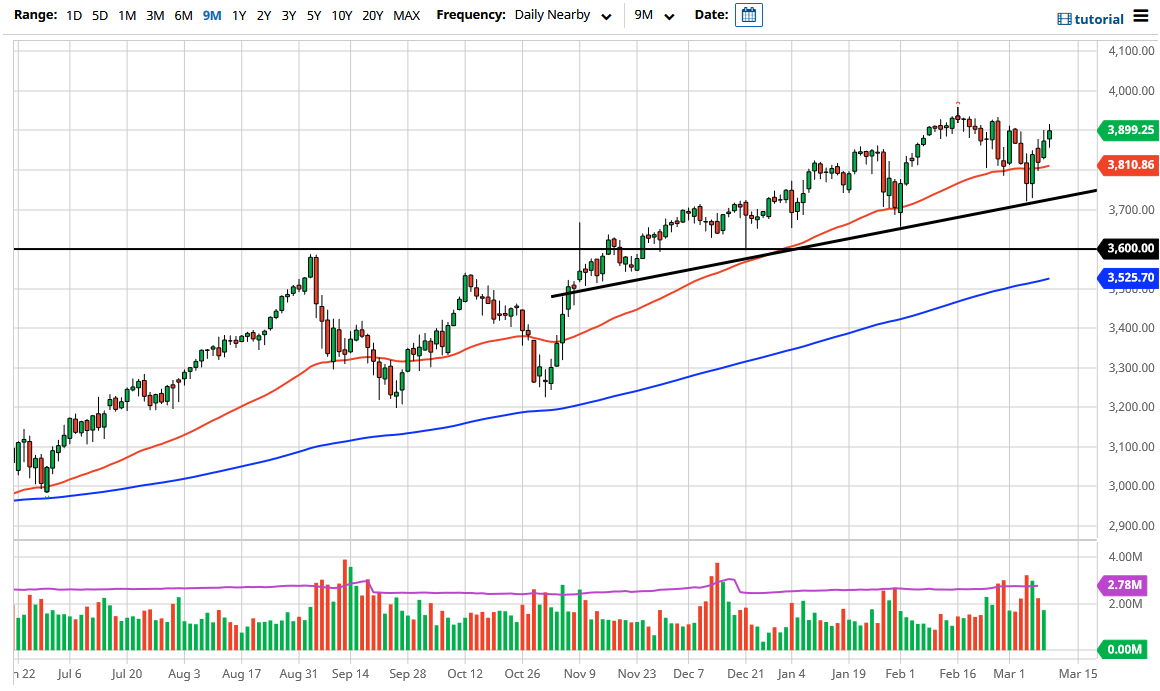

Nonetheless, it looks as if the market is still bullish, and I think at this point it looks like we may struggle a bit, as we see a lot of rotation. The 3900 level could cause a little bit of trouble, but I think any pullback will be bought into. The NASDAQ 100 fell apart, and that continues to have ripple effects in the markets overall. While I do believe that eventually will go higher, it is also possible that we could see a little bit of a pullback in order to get long again. The 50 day EMA currently sits at the 3810 level. The uptrend line is underneath there as well, where we had bounced from. It is not until we break down below that level that I would be somewhat concerned about the market, but I do believe that the 3600 level is also massively supportive.

If we do see this market break out above the highs of the day, then expect the S&P 500 to challenge the 3940 handle, and then possibly finally make the move to the 4000 level that we have been waiting on for so long. We are in a nice uptrend, so I do expect that to happen eventually, but I also recognize that there is a lot of noise just above and of course a lot of noise around the world right now from a fundamental standpoint as well. Nonetheless, it does appear that traders are trying to price in the idea of the reopening of global economies to be very strong. I have no interest in shorting this market, but if we did break down below the 3600 level, I would be a buyer of puts, because at least at that point in time you can get a grip on what type of risk you have.