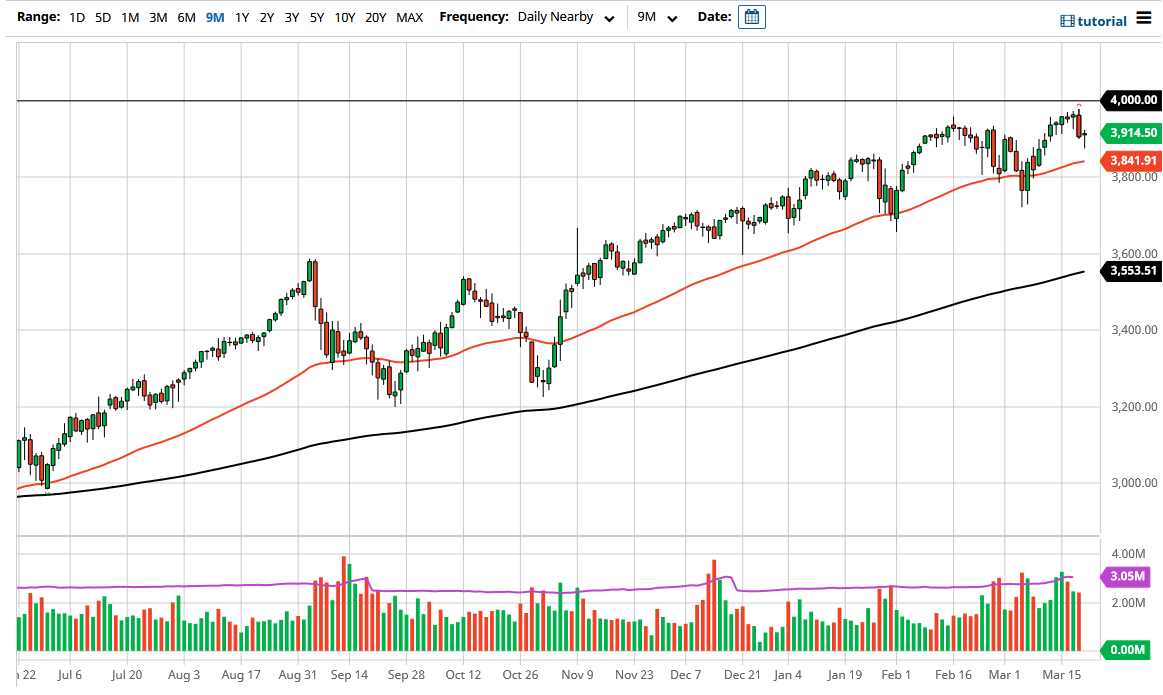

The S&P 500 fell during most of the trading session on Friday but also turned around by the end of the session. It is worth noting that the market was also dealing with quad witching, which is when four different asset have quarterly options expiring at the same time. I think it is only a matter of time before we see a lot of chopping around, and then the Monday session is probably going to be noisy as well, due to the fact that you will have large positions put back on as options will be rolled over.

The 50-day EMA underneath continues to offer support from a psychological standpoint as well, so I think is probably only a matter of time before the buyers come back in and pick up this market yet again. I do believe that we are still looking at the 4000 level as a potential target, and it will probably take quite some time to get there. The overall market attitude is positive in general, despite the fact that we have heard a lot of noise coming out of the bond markets.

The 10-year yield will continue to play a big part in what happens with the stock market, as the interest rates have reached as high as 1.75% over the last couple of days. If we continue to see a surge in yields, that will almost certainly place downward pressure on this market. Nonetheless, even if we did break down below the 3800 level, I would still only be buying puts and not shorting this market as you simply cannot do that with the US indices.

If we do break above the 4000 handle, then I think the first target will be the 4100 level, possibly even the 4250 level over the longer term. We need to see a daily close above that 4000 handle, which I think also probably will attract a lot of attention just due to the big figure aspect. In general, this is a market that I think will continue to see volatility, so be cautious about the position size that you have invested in this market. If we can get above the 4000 handle, then I think I will add to a bullish position at that point.