The S&P 500 pulled back just a bit during the trading session on Tuesday to reach down towards the 3080 handle. The market had gained quite significantly during the trading session on Monday, so this slight pullback is hardly anything to look at. On the other hand, even if we do continue to fall, I think there are plenty of buyers underneath. The size of the candlestick on Tuesday is also rather small, so that is something worth noting as well, because it means that there was not any type of panic.

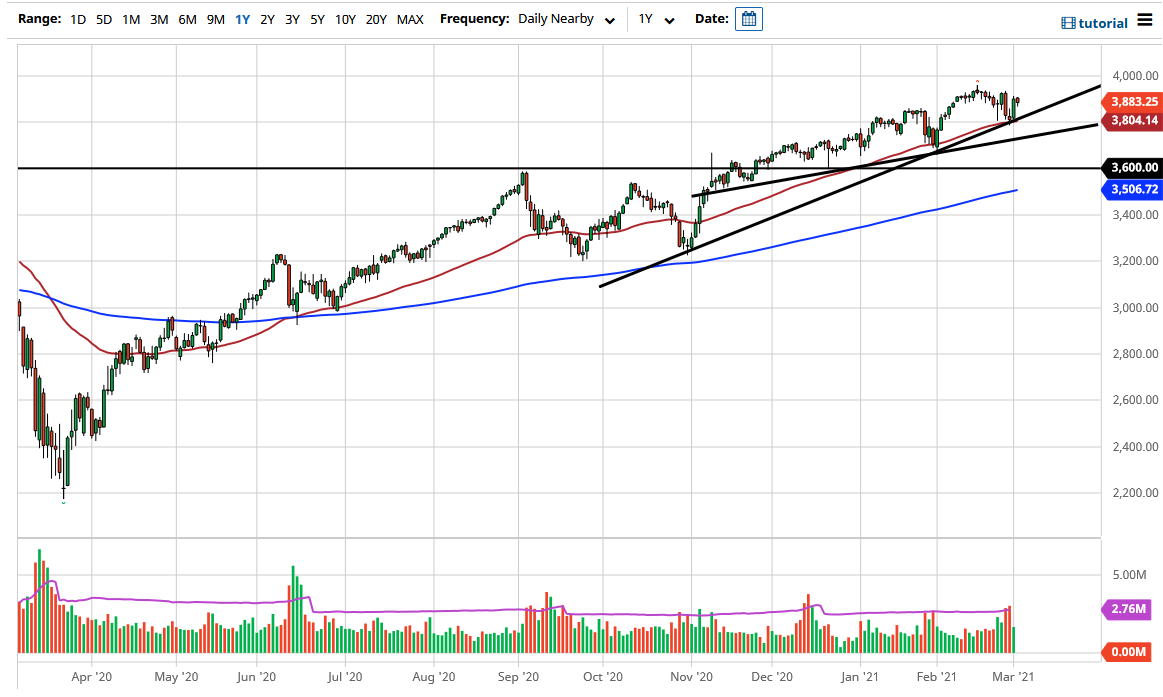

The 50-day EMA underneath has caused a bit of a bounce, which is sitting right at the uptrend line as well. Ultimately, this is an area that I think would be very interesting for a lot of traders, but if we were to break down below the 3800 level, then the market is likely to go looking towards the other trend line just below. After that, the 3600 level is an area where I would expect to see a lot of support as well. Furthermore, the 200-day EMA is starting to reach towards that area, so I think it is only a matter of time before buyers would return.

You have to keep in mind that the Federal Reserve has one mandate at this point: to keep asset prices inflated. I know that it is not its “official mandate”, but at the end of the day it is likely that we will see more central bank intervention in order to keep the market afloat due to the recent spike in bond yields, so it may be more or less a “backdoor path” to support the stock market, like an increase in securities purchases in the bond markets. If that drives down rates, then it will be yet another reason to send this market higher. Regardless, we are very much in an uptrend at this point and that has not changed. Buying the dips continues to work, but if we were to break down below the 200-day EMA, then I would be a buyer of puts. But I have absolutely no interest in shorting US indices, as they are far too padded by the Federal Reserve, so you are either long of the market or you are on the sidelines.