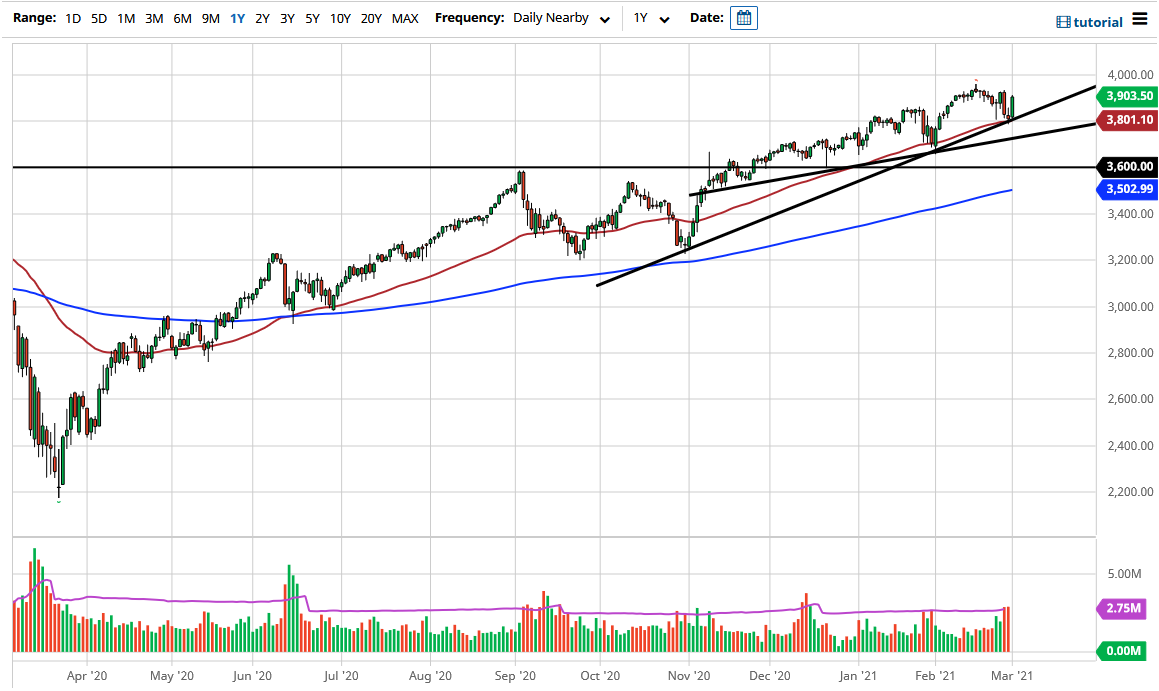

The S&P 500 rallied quite significantly during the trading session on Monday to reach just above the 3900 level. The 3900 level is a large, round, psychologically significant figure, but what I do find interesting is that the market rallied 2.4% to break above a significant inverted hammer at a major uptrend line. Furthermore, the 50-day EMA was sitting just below that candlestick as well, so it is a bullish sign. The market still has a little bit of resistance above, but I do think that it is only a matter of time before we break out and go looking towards the 4000 level, which has been my longer-term target for some time.

Pullbacks at this point will more than likely be supported between here and the uptrend line, and as a result, it is likely that we would see value hunters coming back into the marketplace as the S&P 500 is offering value at a technical support level. Now that we have closed towards the top of the candlestick, it becomes obvious to me that we will more than likely see some type of continuation given enough time. We may get a short-term pullback in the meantime, but I think that will only be looked at as a potential buying opportunity that people will be more than willing to take advantage of.

Longer term, the 4000 level is my target, based upon the previous consolidation down between the 3200 level and the 3600 level. Once we break out of there, the idea is that we are going to reach towards 4000 based upon that breakout. In general, I think this is a market that will eventually break above that 4000 handle, but I would also expect to see a significant amount of profit-taking in that area from a psychological standpoint if nothing else. I also anticipate that the market will get above there and perhaps go looking towards the 4100 level next, and a lot of the pundits are looking at this as the market getting to this major figure much quicker than anticipated, as a lot of people that I speak to have a target of 4000 by the end of the year. Nonetheless, we continue to see a lot of bullish pressure and therefore you have to swim with the river, not against it.