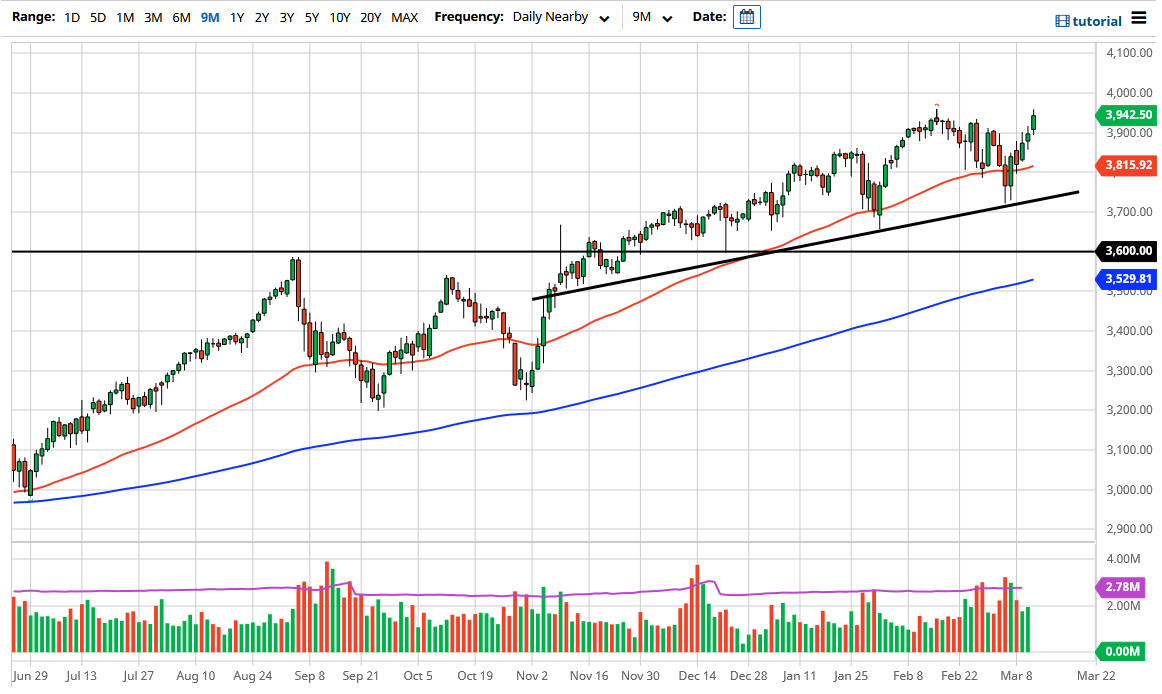

The S&P 500 has shown itself to be bullish yet again during the trading session on Thursday, as we have reached towards the 3950 level. That is an area that has caused a certain amount of resistance previously, so the fact that we pulled back from there at the end of the day should not be a huge surprise. All things being equal, I do think that we get to the 4000 level above, as it is a large, round, psychologically significant figure and we have been trying to get to the level for some time. We look at the previous consolidation area, we had been bouncing around between the 3200 level on the bottom and the 3600 level on the top, so I do think that it is probably only a matter of time before we fulfill the “measured move” to reach towards the 4000 handle.

All that being said, we have had a shot straight up in the air from the uptrend line, so do not be surprised at all if the Friday session sees a little bit of profit-taking, as traders might be a little bit leery to hold onto a position into the weekend. However, that does not necessarily mean that you are looking to short this market, rather you are looking to find value on dips that you can take advantage of. In fact, that has been the way to make the most money in this market over the longer term. The Federal Reserve continues to come in and pick up the market every time it falls just a little bit too far, and the fact that yields in the United States have been dropping over the last couple of days gives stock traders the impetus to continue to buy.

I do not necessarily think that the market will simply slice through the 4000 level, but I do think eventually we break above there. I think that we are going to see a lot of noisy trading back and forth on the way up there, but eventually we will leave 4000 in the rearview mirror, and it is likely that we would see the market then continue to be more of a “buy-and-hold” attitude. Everybody’s banking on the reopening trade, so I think that is what we are seen played out here.