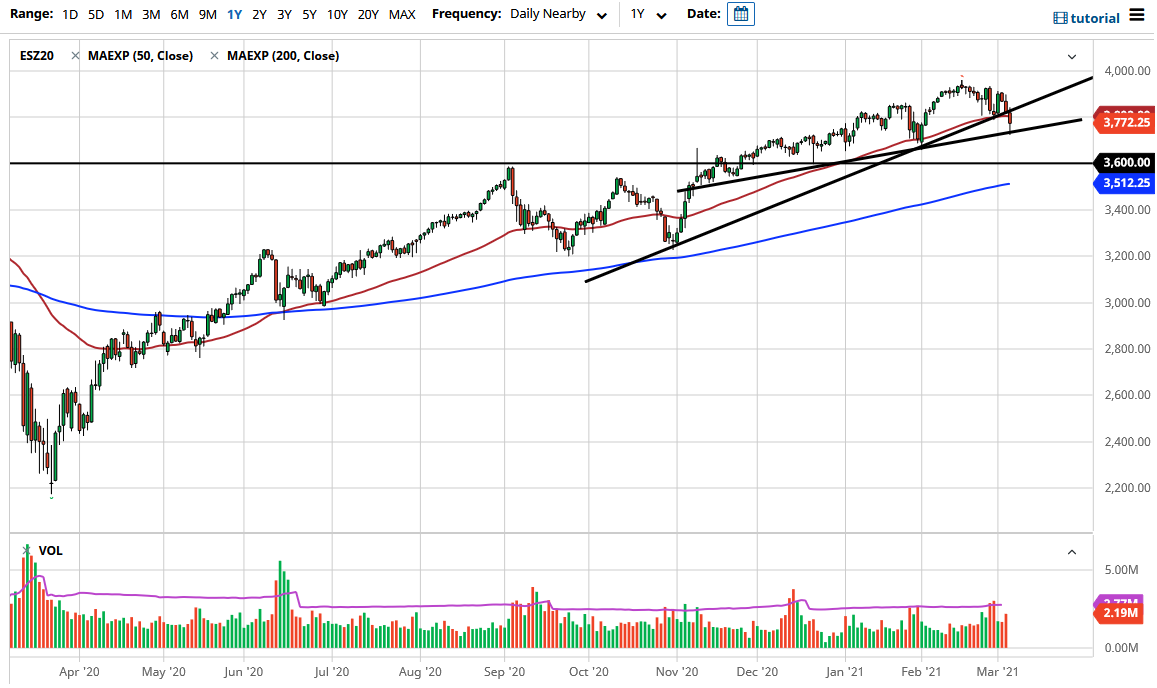

The S&P 500 has broken down significantly during the trading session on Thursday to slice down through the 50 day EMA and continue to go down to the previous uptrend line. We have bounced from that level rather significantly, so that does at least show the market being resilient to a point, and as a result the market is likely to continue to look for some type of opportunity to go to the upside. By bouncing above and from the uptrend line, it does suggest that perhaps we could get a bigger push, especially if the jobs number comes out in a favorable light.

Keep in mind that a lot of what had caused this market to break down was that Jerome Powell chose not to address the bond market in a satisfactory way during his speech. By a letting it go, market participants got the “green light” to continue shorting the bond market, driving yields up. The yields rising makes the US dollar more attractive, and as a result money starts to flow from one direction to another and will see rebalancing of portfolios. The question now is whether or not there is some big, huge “fear trade” coming back into the marketplace, or we are simply rotating from one sector to another? The candlestick does show quite a bit of negativity, but the fact that we are heading into Non-Farm Payroll Friday could lead to increased volatility.

Underneath, we could see the 3600 level as a potential support level as well, as the 200 day EMA is starting to race towards that area, an area that was the scene of a significant break out. Previously, we had been consolidating between the 3200 level on the bottom, and the 3600 level at the top. That 400 point range suggests that we will eventually go looking towards the 4000 handle. That being said, we have not pulled back towards the 3600 level quite yet, and therefore we could see a lot of buying in that area. That being said, the market is likely to continue to see volatility, but you need to pay close attention to the 10 year yield more than anything else. If that yield starts to drop, then the stock markets will turn around and go to the upside. However, if those yields continue to spike, the market will probably struggle.