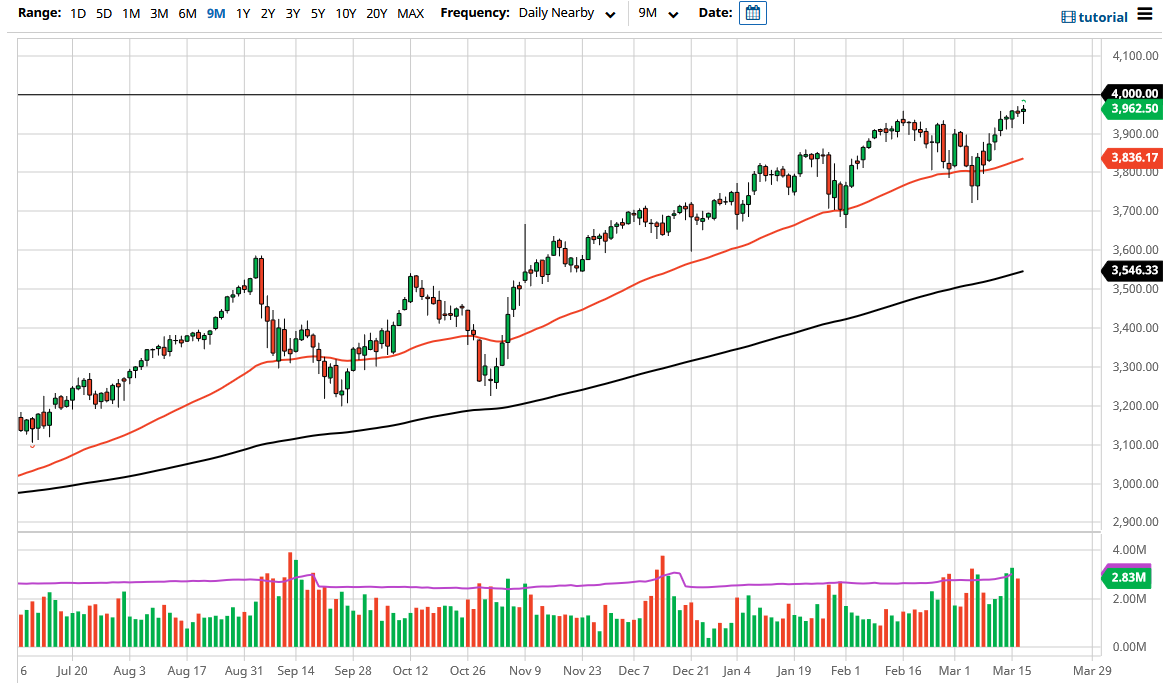

The S&P 500 initially pulled back during the trading session on Wednesday only to turn around and show signs of strength. By forming the candlestick that we did, it suggests that we are going to continue to go higher. The 4000 level above will continue to be a level that people pay close attention to, and if we can break above that level it is likely that we will continue to go much higher. Closing above the 4000 level on a daily timeframe suggests that we are ready to continue to go much higher. Having said that, Friday is “quadruple witching”, which means that the markets will probably be crazy at the end of the week due to the fact that we have four different options markets settling.

At this point, I do believe that it is only a matter of time before the market finds a reason to go higher, but quad witching may come into play. The 3900 level underneath should be supportive, so I think that we will continue to see buyers jumping in. I also recognize that weekly jobless claims could come into the picture as well on Thursday, but we are in a very bullish market, and that is really the most important thing to pay attention to. You obviously cannot short this market, but I could have said that for most of the last 13 years.

As long as the Federal Reserve is willing to liquefy the market (and based upon the FOMC during the trading session it appears they are), I think it is only a matter of time before the market takes off. Pullbacks at this point will be supported by the Federal Reserve as we have seen over the last 13 years, so that is only thing that we can take a look at. The bond market has been seeing higher yields, but at this point it continues to be a bit of a drag. As long as the 10-year yield does not get out of control, it is likely that we will see the S&P 500 rally. The area that seems to be kicking off the most concerned is the 1.7% level.