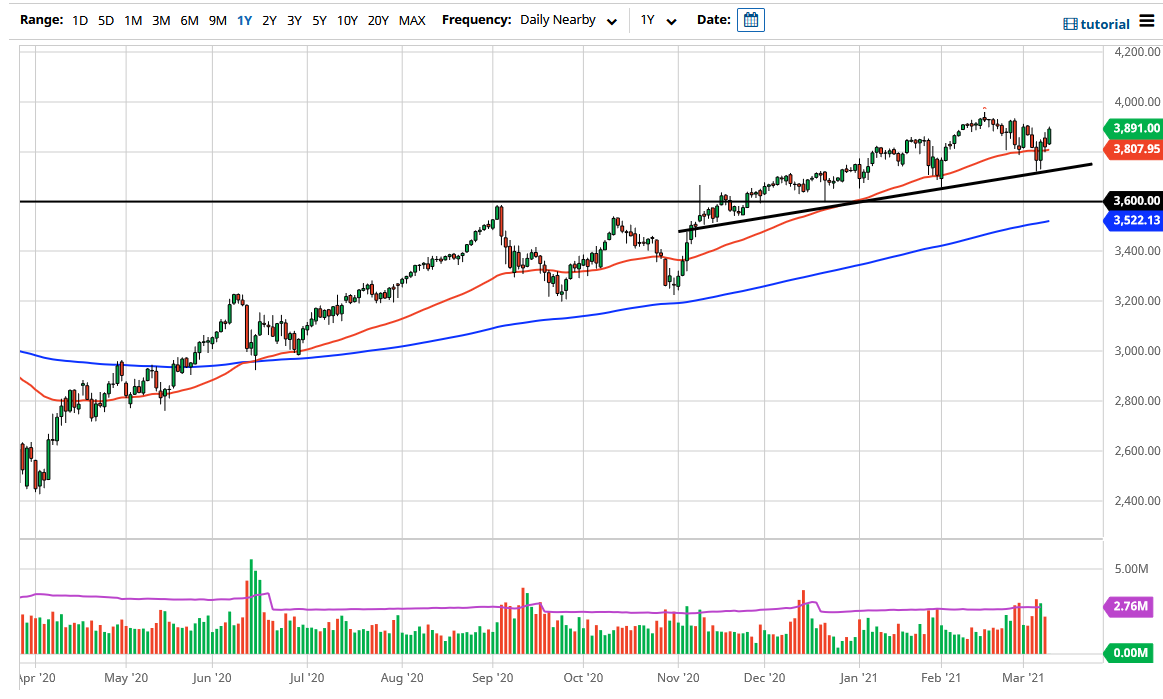

The S&P 500 rallied significantly during the trading session on Tuesday to reach towards the 3900 level but has fallen just a bit short. Nonetheless, we have recaptured the 50-day EMA and have broken above the highs of the previous session. This is after forming a little bit of a “micro bottom” at the uptrend line, so I think there are plenty of reasons to think that this market will probably continue to go higher eventually. After all, we have seen a lot of volatility, but at the end of the day the buyers continue to jump in and buy the S&P 500, because that is what Wall Street does.

Yields in the 10-year note finally dropped during the trading session, which was like rocket fuel for stocks and some beta currencies, so the result was relatively predictable. At this point in time, the market is likely to continue to go looking towards the 3900 level and then eventually the 4000 level which is the longer-term target. I have been talking about 4000 for what seems like forever now, as it has taken forever to get up here. The market recently had been consolidating between 3200 on the bottom and 3600 on the top, and by the simple measuring move of a rectangle, it gives us a target of 4000.

The size of the candlestick is relatively notable, not necessarily the link, but the fact that we closed towards the top of it. Furthermore, we had seen a little bit of acceleration into the close, which is almost always a very good sign as well. I think you need to keep an eye on the 10-year note going forward, and as long as the interest rates do not continue to rise, we should be in good shape and should continue to be able to go higher. That has been the main driver of stocks for a moment now, and at this point it is still very much in the mind of traders. With that being the case, you need to have both charts open, but you should be able to trade based upon what is going on over there in the bond markets. Furthermore, we have stimulus coming and it is all but a signed bill, meaning that more cheap money is coming.