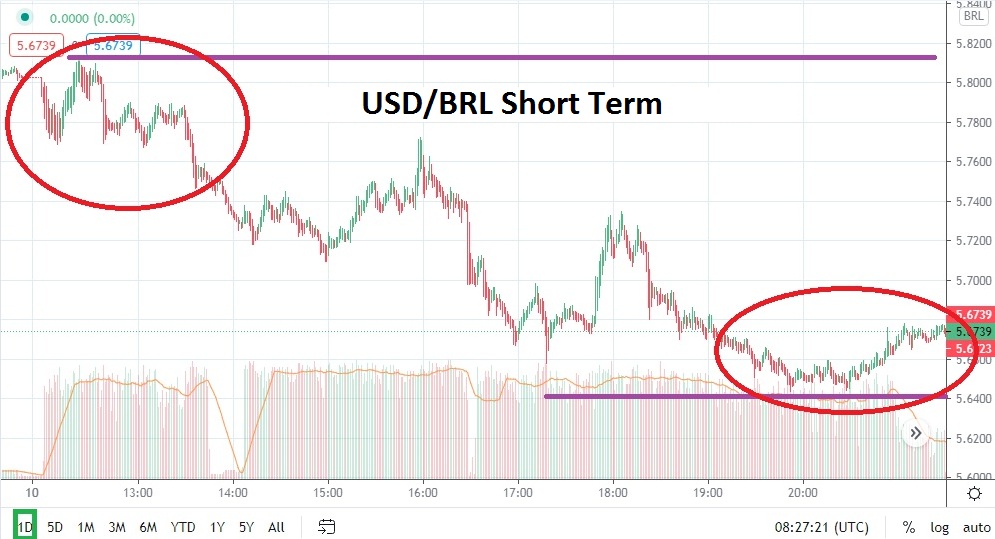

The USD/BRL has seen a slight bearish reversal lower the past couple of days which speculators of the Forex pair will find intriguing. The USD/BRL has proven a difficult Forex pair to trade over the mid-term because it has had a unique ability to trade in a manner which has not been correlated in many respects with the global Forex marketplace. However, the past two days of trading, and in fact the past week of trading, have actually mirrored many other major Forex pairs.

The USD/BRL is near support junctures which should be watched closely. The 5.6400 to 5.5700 levels are nearby, and if they prove vulnerable, the USD/BRL could make an attempt to recapture its mid-term range of 5.5300 to 5.3400 which has dominated price action for a while. However, on the 26th of February, the USD/BRL began to display a strong amount of bullish activity, which actually correlated to other Forex pairs globally.

Before the bullish trend from late February until a couple of days ago within the USD/BRL, the Forex pair was demonstrating a tendency to incrementally rise in value too. This creates the notion that the USD/BRL was able to mimic other Forex pairs technically the past couple of weeks while seeing a strong bullish trend emerge, which actually took it above efficient highs. The USD/BRL may have risen too fast like many other Forex pairs when risk-averse sentiment hit the global markets due to a shift in short-term sentiment.

Speculators may have a chance to actually wager on selling positions of the USD/BRL and look for support levels to be tested. Trading within the USD/BRL has proven difficult mid-term and traders should be prepared and use tactical limit orders that are quick hitting and do not look for huge moves. If the USD/BRL actually continues to correlate with other major Forex pairs in the short term, it might show it has the ability to retrace and reestablish its strong mid-term range slightly below current values.

Traders may want to consider shorting the USD/BRL on slight reversals higher and place their take-profit positions near support levels which are within close proximity. Risk management needs to be used within the USD/BRL, and traders who use current resistance levels as stop losses may find positive results short term if they seek polite profits with short-term outlooks.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.7100

Current Support: 5.6400

High Target: 5.8100

Low Target: 5.5700