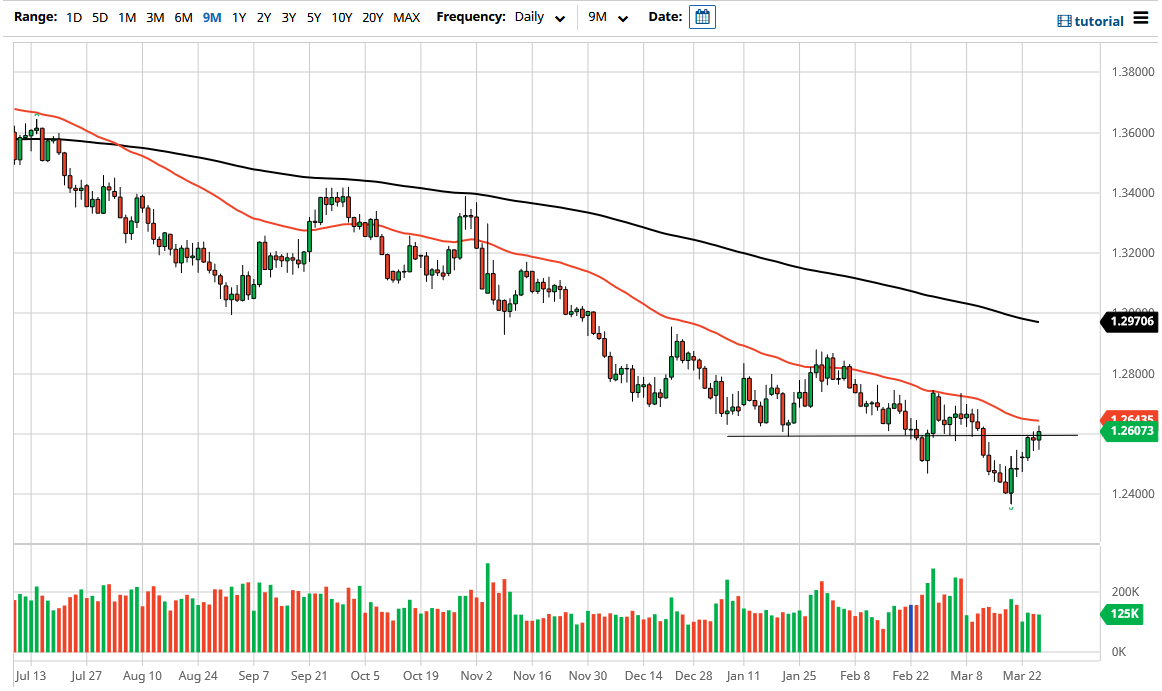

The US dollar initially fell during the trading session on Thursday only to turn around and show signs of life again. The 1.26 level has been important more than once, as we have seen both buyers and sellers show up there. Now that we are approaching that level and have even broke above it, we have a lot of questions just above as to whether or not we can continue to go higher. If we do, the 50 day EMA being broken would be a trigger that I would use for a potential buying opportunity.

When you look at the weekly chart, the previous week ended up forming a massive hammer, which of course is a very bullish sign. The 1.24 level of course is an area that is worth paying attention to based upon the monthly timeframe, where we had seen a lot of buyers from that general vicinity. The bounce has been impressive, and it does tie in with the oil markets selling off quite drastically, as crude oil demand is becoming an issue, especially with the European Union shutting itself down and being unable to vaccinate its population.

That being said, the market breaking above the 50 day EMA could send this market looking towards the 1.28 handle, and then eventually the 200 day EMA above. The Initial Jobless Claims came out during the trading session on Thursday, and although there are over 600,000 people applying for first-time jobless claims, the number was better than anticipated and the rate of change is starting to go forward and more positive, so that is another reason to think that the US dollar may continue to be favored.

Bond yields of course come into play, and with the US bond yields rising overall, that continues to push the US dollar higher. The differentiation between US and Canadian bonds will continue to be a factor as well, so at this point I think we could get a little bit of a pullback, but unless oil starts to take off, it is very unlikely that we can continue to go significantly lower. I do think that is going to be very noisy, so you may be looking for buying opportunities on short-term charts more than anything else. If we do break above the 1.28 level, then it is more of a “buy-and-hold” type of situation.