The announcement of the decline in Japanese economic growth gave the USD/JPY additional impetus to complete the correction to the upside. The bounce gains brought it to the 109.23 resistance level, the highest for the currency pair in nine months. With the technical indicators moving to strong oversold levels, and with the bond gains that have stirred the markets recently, the pair quickly returned to retreat to the 108.41 support level before settling around 108.70 at the beginning of trading Wednesday and ahead of the US inflation figures.

Economists at Wall Street Bank Morgan Stanley expect that the US dollar will achieve more gains during 2021, after they entered the year expecting the US currency to suffer losses. "Our view of the US dollar in 2021 has evolved from a fall at the beginning of the year to neutral in mid-January, and is now taking an upward divergence," says Matthew Hornbach, an analyst at Morgan Stanley.

Economist forecast surveys conducted in late 2020 and early 2021 showed that the vast majority of analysts expected a decline in the dollar, but that consensus has deteriorated since then given the currency's strong performance in recent weeks. In a research brief released this week, Morgan Stanley said that the bullish divergence shows that strong US data is increasingly dominating the US dollar's behavior, while the Fed's dovish signals were previously able to hold back continued gains.

"The unstoppable strength of the US economy overcomes the cautious signals from the Fed, and causes some cracks to appear in the Forex market, which leads to the strength of the US dollar," Hornbach added.

The US dollar was one of the best-performing currencies over the past week, gaining 1.58% against the euro and pushing the euro against the dollar below 1.20 and then 1.1835 in the process. The British pound - one of the best performers in 2021 - was also unable to resist the dollar's advance, as the pound's exchange rate fell to the dollar below 1.40 to hit its lowest level on Monday, below the 1.38 support.

The dollar's strength comes as investors bet on a strong US economic recovery, which in turn will stimulate inflation in the coming months. As a result, investors dumped government bonds - especially long-term ones - and in the process increased the yield paid on those bonds. At the same time, financial market pricing indicates that investors are providing the date when they expect the first US interest rate hike to happen.

Accordingly, analysts say that all this is driving more demand for the dollar. Morgan Stanely expects the EUR/USD exchange rate to be 1.23 by the end of June 2021 and 1.25 by the end of the year. While the outlook for the EUR/USD pair does not necessarily reflect the stated view that Morgan Stanley now predicts dollar strength in 2021, this strength is evident in the outlook against the pound.

The exchange rate of the GBP/USD is expected to be 1.35 by the end of June 2021 and at 1.32 by the end of the year.

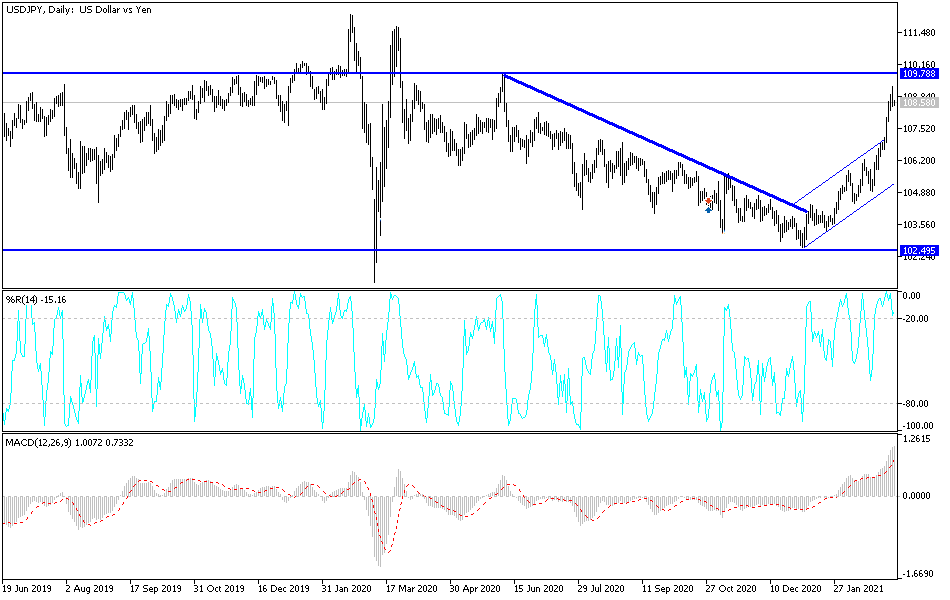

Technical analysis of the pair:

Despite the stalled gains of the USD/JPY's recent bounce, it is still moving within its ascending channel, and the psychological resistance of 110.00 remains an important target for the bulls. On the other hand, there will be a break of the current bullish trend for the pair if it moves towards the support level at 106.65 and below it. At the present time, with the technical indicators reaching overbought areas, I prefer selling the currency pair from every upward level.

In addition to the extent of investor risk appetite, the currency pair will be affected by the announcement of US inflation figures, according to the CPI reading.