Renewed fears and risk-averse sentiment were positive for the Japanese yen against the rest of the other major currencies. Accordingly, the USD/JPY moved towards the 108.40 support level before settling around the 108.60 level at the time of writing. The performance of the currency pair differs greatly from the performance of the rest of the major pairs that are witnessing an upward rebound amid a state of optimism for the future of the US economy. This is largely due to assurances from monetary and financial policy officials that the latest and awaited stimulus plans, along with progress in the course of vaccinations against the virus, will ensure a rapid economic recovery.

US new home sales fell 18.2% in February due to severe winter weather in many parts of the country and a shortage of supply which affected the housing industry. Accordingly, the US Commerce Department reported that sales of single-family homes fell to a seasonally adjusted annual rate of 775,000 last month, the slowest pace of sales since May of last year.

Every region in the country has seen sales decline.

The average price of a new home sold in the United States during the month of February was $349,400, an increase of 5.3% over the previous year. The same weather disruption was evident in the existing home market, which released data confirming that sales fell 6.5% last month. Therefore, yesterday's report recorded the first decline in US new home sales in two months. Housing remains one of the few bright spots during the coronavirus pandemic. Last year, new home sales rose to levels not seen since the housing boom in the mid-2000s.

Despite the hiccups, economists do not believe that even higher prices will cool the US housing market. Rising timber costs and high mortgage rates, although still close to their lowest levels, along with a handful of properties available for sale, are pushing home ownership out of range for many.

A senior United Nations health expert said that the weekly number of COVID-19 deaths in the world is rising again, describing it as a "worrying sign" after about six weeks of decline. Accordingly, Maria Van Kerkhove, WHO's Technical Lead on COVID-19, says cases are on the rise in four of the WHO's five regions around the world.

Van Kerkhove told a news conference that cases in Europe increased by 12% last week. The impetus for the rise was the spread of a variant that first appeared in Britain and spread to many other places, including Eastern Europe. She said that the Southeast Asia region recorded a jump of 49% over the past week, while the Western Pacific region of the World Health Organization recorded an increase of 29%.

Meanwhile, the Americas and Africa recorded declines.

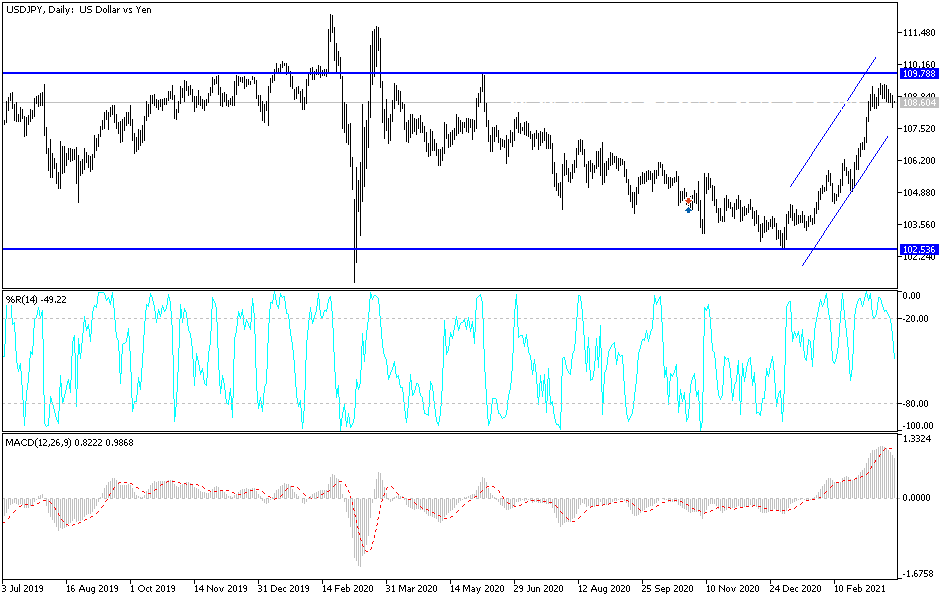

Technical analysis of the pair:

The current success of the bears in moving the USD/JPY towards the support level at 108.00 will increase the strength of the current bearish momentum and thus move towards stronger support levels, the closest of which are 107.45 and 106.80. On the upside, as I emphasized before, the bulls still need to test and break through the psychological resistance of 110.00 to confirm the strength of the recent upward move, which was recently reflected amid renewed fears and risk-averse sentiment.

Today, the currency pair will be affected by US announcements as durable goods order numbers will be released, followed by the second testimony from Federal Reserve Chairman Jerome Powell.